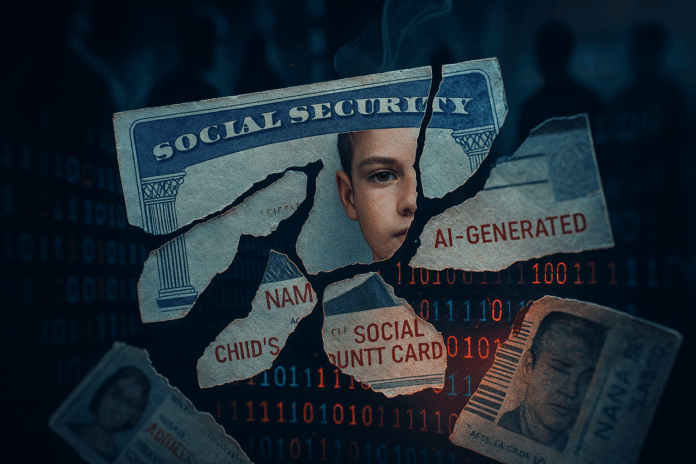

Picture this: Your 12-year-old child applies for their first student credit card, only to discover a $15,000 auto loan already devastating their credit history. This isn’t science fiction—it’s the chilling reality of synthetic identity fraud, the fastest-growing financial crime in America. Unlike traditional identity theft where you’d notice suspicious charges immediately, synthetic fraud operates in stealth mode. It’s cost businesses $6 billion annually and is projected to balloon to $23 billion by 2030. Why should this keep you awake at night? Because criminals aren’t stealing your identity—they’re inventing new ones using fragments of real data blended with fabricated details. These Frankenstein identities fly under the radar for years, building fake credit histories before vanishing with maxed-out loans. By the time anyone notices, the damage is catastrophic.

The Anatomy of a Frankenstein ID

Synthetic identities are stitched together from real components and fictional layers. Fraudsters harvest data from breaches or dark web markets where Social Security Numbers sell for $1–$5. Generative AI tools now automate this process, creating convincing IDs in minutes. Example: A criminal uses a toddler’s legitimate Social Security Number combined with a false name and fabricated Arizona address. This hybrid persona then applies for credit cards, loans, or government benefits.

The 3-Stage Con Game

Phase 1: Gathering & Blending involves collecting real data like children’s Social Security Numbers and pairing them with invented details. Phase 2: Nurturing sees fraudsters train the synthetic identity by opening small credit lines and making timely payments for months or years. One synthetic ID in Florida maintained a 780 credit score for three years before a $240,000 bust-out. Phase 3: Bust-Out occurs once credit limits peak, when fraudsters drain every account and disappear—leaving banks holding empty bags.

Synthetic vs. Traditional Identity Theft

Traditional identity theft steals your existing identity, gets detected quickly through odd charges, and impacts one person. Synthetic fraud creates a new hybrid identity, remains undetected for years, slowly builds trust before striking, and harms businesses while blasting credit systems.

Why This Year Marks the Tipping Point

The AI Arms Race Escalates

Generative AI has turned fraud into a scalable industry. Fraudulent facial verification attempts exploded by 1,100% in early 2025. Criminals use tools to clone voices, forge documents, and bypass biometric checks. For $50/month, amateur scammers buy crime kits with phishing templates, synthetic ID generators, and money-laundering tools.

Bullseye on the Vulnerable

Children and seniors face disproportionate risk. Over 1.5 million U.S. minors had their Social Security Numbers compromised last year—often undiscovered until they apply for college loans. Elderly and homeless individuals rarely check credit reports, making their data low-risk targets. A Michigan nursing home breach led to 400 synthetic IDs linked to residents’ Social Security Numbers.

Dark Web Data Factories

The dark web’s identity theft market is growing at 22.3% annually, projected to hit $1.3 billion by 2028. Hackers now bundle synthetic ID starter packs with Social Security Numbers, fake driver’s licenses, and pre-aged credit profiles. Shockingly, 95% of standard onboarding systems fail to flag synthetic IDs because most verification checks don’t cross-reference Social Security Numbers against birth dates or flag impossible credit histories.

Spotting Synthetic Fraud: Red Flags You Can’t Afford to Miss

For Individuals

Watch for credit report oddities: accounts you didn’t open, addresses where you’ve never lived, or IRS notices about income you never earned. For parents, warning signs include credit offers in your child’s name or Social Security Administration alerts about minor’s Social Security Number activity.

For Businesses

Key detection indicators include mismatched age and credit history, rapid fund cycling between accounts, sparse digital footprints, and recent surges in credit applications. AI defense tools like machine learning algorithms analyze behavioral biometrics to spot bot-like patterns. Cross-database validation confirms Social Security Number, name, and birthdate alignment across government systems.

Your Action Plan Against Synthetic Fraud

For Consumers

Freeze your child’s credit with Equifax, Experian, and TransUnion to lock minors’ Social Security Numbers. Monitor credit reports weekly using free services. Set fraud alerts if you spot anomalies. Report suspicious activity immediately to the Federal Trade Commission, FBI’s cybercrime division, and your bank’s fraud department.

For Businesses

Deploy multi-layered verification combining biometric liveness checks with behavioral analysis that flags devices masking IPs. Adopt real-time AI monitoring systems that analyze transactions across 10,000+ risk signals, reducing detection gaps by 60% versus manual reviews. Join industry consortia to share anonymized fraud patterns with other financial institutions.

The Future: AI Arms Race and Regulatory Shifts

Fraudster Innovations

Crime rings now manage synthetic ID nurseries, using artificial intelligence to automate credit-building phases for hundreds of identities simultaneously. Scammers impersonate bank representatives via AI-generated calls to extract verification codes, exploiting the trust we place in familiar voices.

Defense Breakthroughs

Mobile Driver’s Licenses with encrypted biometrics are rolling out in California and New York, making forgery near-impossible. Stricter regulations include the EU’s 72-hour payment hold rule for suspicious transfers and the UK’s Failure to Prevent Fraud corporate offense carrying massive fines. Financial institutions increasingly implement deepfake detection algorithms that analyze facial micro-expressions and speech patterns.

Your Shield Against the Invisible Threat

Synthetic identity fraud isn’t just a bank problem—it’s eroding the foundation of digital trust. But awareness is your greatest weapon. By freezing your family’s credit, demanding biometric logins, and choosing businesses that verify you—not just your Social Security Number—you build walls these criminals can’t scale. Assume your data is already compromised. Protect what matters before the storm hits. Do this today: Freeze your child’s credit, enable transaction alerts on all financial accounts, and share this knowledge—your elderly parent or college-bound neighbor might be the next target. The synthetic fraud surge won’t retreat, but together, we can starve it of victims. Stay vigilant, stay informed, and trust your instincts when something feels off. Your financial legacy depends on it.