Nigeria’s financial landscape is undergoing a significant transformation. The rapid adoption of digital banking and fintech solutions has revolutionized how Nigerians manage their finances. From bustling urban centers to remote rural areas, mobile apps and online platforms have made banking more accessible than ever before.

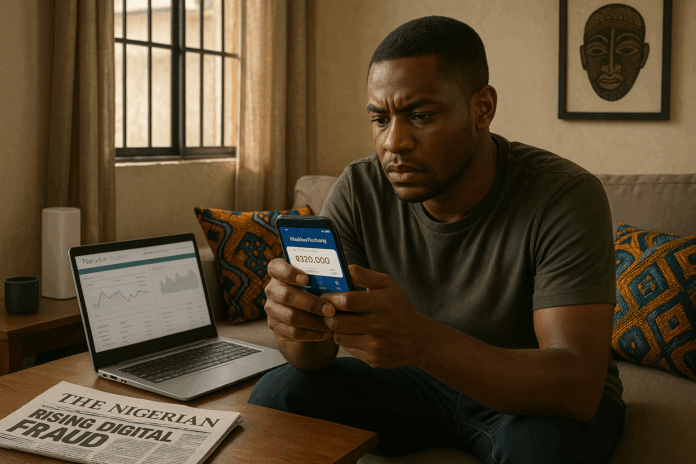

However, this digital revolution comes with its own set of challenges. As more individuals embrace online banking, cybercriminals are finding new avenues to exploit vulnerabilities. The convenience of digital transactions is being overshadowed by the rising threat of fraud and cyberattacks.

For financially cautious individuals, this presents a dilemma. How can one enjoy the benefits of digital banking while ensuring their financial security? The answer lies in understanding the risks, staying informed about the latest threats, and adopting best practices to safeguard one’s assets.

In this article, we’ll delve deep into the current state of digital banking in Nigeria, explore the prevalent fraud schemes, and provide actionable insights to help you navigate this digital era securely.

The Landscape of Digital Banking Fraud in Nigeria

The digital transformation of Nigeria’s banking sector has brought unprecedented convenience to millions. With a few taps on a smartphone, individuals can transfer funds, pay bills, and manage investments. However, this convenience has also opened doors to cybercriminals who exploit vulnerabilities in digital banking systems.

In 2024, Nigerian financial institutions reported significant losses due to fraud. According to data, fraud losses amounted to ₦52.26 billion, a sharp increase from ₦17.67 billion in 2023. This surge underscores the escalating threat of digital banking fraud in the country.

Several prevalent fraud techniques have been identified:

- Social Engineering: Fraudsters manipulate individuals into divulging confidential information. In Q1 2024, social engineering accounted for 10,007 fraud attempts, making it the most common technique.

- Phishing: Cybercriminals send deceptive messages, often mimicking legitimate institutions, to trick users into revealing sensitive data.

- SIM Swap Fraud: Attackers hijack a victim’s mobile number to gain access to banking information.

Lagos State has been identified as the epicenter of these fraudulent activities, accounting for approximately 57% of reported cases in Q1 2024. This concentration highlights the need for heightened vigilance, especially in urban centers.

The rise in digital banking fraud poses a significant challenge to Nigeria’s financial ecosystem. As the country continues to embrace digital banking, it becomes imperative for individuals and institutions to adopt robust security measures and stay informed about emerging threats.

Regulatory Measures and Institutional Responses

In the face of escalating digital banking fraud, Nigeria’s financial regulators have taken proactive steps to fortify the nation’s cybersecurity infrastructure. The Central Bank of Nigeria (CBN) and the Nigeria Electronic Fraud Forum (NeFF) have been at the forefront of these initiatives, implementing frameworks and fostering collaborations aimed at safeguarding the integrity of digital financial transactions.

Central Bank of Nigeria’s Risk-Based Cybersecurity Framework

Recognizing the evolving nature of cyber threats, the CBN introduced the Risk-Based Cybersecurity Framework and Guidelines for Deposit Money Banks (DMBs) and Payment Service Banks (PSBs) in May 2024, with implementation commencing on July 1, 2024. This framework supersedes the 2018 guidelines, integrating recent legal and technological advancements to address contemporary cybersecurity challenges.

The framework mandates that supervised financial institutions (SFIs) establish robust cybersecurity governance structures. This includes defining clear roles for the Board of Directors, Senior Management, and the Chief Information Security Officer (CISO), ensuring accountability and strategic oversight.

Key components of the framework encompass:

- Cybersecurity Risk Management System: SFIs are required to identify, assess, and mitigate cybersecurity risks, aligning their strategies with the criticality of information assets.

- Enhancing Cybersecurity Resilience: Institutions must develop capabilities to detect, respond to, and recover from cyber incidents, ensuring continuity of operations.

- Emerging Technologies: The framework addresses the adoption of technologies such as artificial intelligence, machine learning, and cloud computing, emphasizing the need for secure integration.

- Metrics, Monitoring & Reporting: SFIs are obligated to implement monitoring processes, report cybersecurity incidents, and conduct annual self-assessments to evaluate compliance and effectiveness.

By enforcing these measures, the CBN aims to bolster the cybersecurity posture of financial institutions, thereby enhancing customer trust in digital banking platforms.

Nigeria Electronic Fraud Forum (NeFF)

Established in 2011, NeFF serves as a collaborative platform comprising banking operators, security agencies, and other stakeholders. Operating under the auspices of the CBN, NeFF’s primary objective is to combat electronic fraud through collective intelligence and coordinated responses.

NeFF’s initiatives include:

- Information Sharing: Facilitating the exchange of fraud-related information among member institutions to enable swift action against emerging threats.

- Public Education: Conducting awareness campaigns to educate the public on fraud prevention strategies and the importance of cybersecurity hygiene.

- Policy Development: Collaborating with stakeholders to formulate effective risk management approaches and regulatory policies.

A notable achievement of NeFF is its partnership with the Association of Mobile Money and Banking Agents of Nigeria (AMMBAN) to introduce a fraud-flagging feature on Point of Sale (PoS) terminals. This functionality prompts for specific Know Your Customer (KYC) details before processing certain transactions, thereby enhancing the detection and prevention of fraudulent activities at agent locations.

Through these concerted efforts, NeFF plays a pivotal role in fortifying Nigeria’s financial ecosystem against the pervasive threat of electronic fraud.

In summary, the collaborative endeavors of the CBN and NeFF underscore a comprehensive approach to cybersecurity, blending regulatory oversight with industry-wide cooperation. These measures are instrumental in fostering a secure digital banking environment, thereby empowering financially cautious individuals to engage confidently with Nigeria’s burgeoning fintech landscape.

Best Practices for Financially Cautious Individuals

Navigating the digital banking landscape in Nigeria requires a proactive approach to security. As cyber threats evolve, adopting best practices becomes essential to safeguard your financial assets. Here’s a comprehensive guide tailored for the vigilant Nigerian banking customer.

1. Strengthen Your Digital Defenses

- Use Strong, Unique Passwords: Create complex passwords combining letters, numbers, and symbols. Avoid using easily guessable information like birthdays or common words.

- Enable Two-Factor Authentication (2FA): Whenever possible, activate 2FA on your banking apps. This adds an extra layer of security by requiring a second form of verification.

- Regularly Update Devices and Apps: Ensure your smartphone and banking applications are up-to-date to benefit from the latest security patches.

2. Be Vigilant Against Phishing and Fraudulent Communications

- Scrutinize Emails and Messages: Be cautious of unsolicited communications requesting personal or financial information. Verify the sender’s authenticity before responding.

- Avoid Clicking Suspicious Links: Refrain from clicking on links or downloading attachments from unknown sources, as they may contain malware.

- Verify Requests for Information: If you receive a request for sensitive information, contact your bank directly through official channels to confirm its legitimacy.

3. Secure Your Devices and Connections

- Install Reliable Security Software: Use reputable antivirus and anti-malware programs to protect your devices from malicious attacks.

- Avoid Public Wi-Fi for Banking Transactions: Public networks can be insecure. Use a secure, private connection when accessing your banking information.

- Lock Your Devices: Set up screen locks and automatic timeouts on your devices to prevent unauthorized access.

4. Monitor Your Accounts Regularly

- Review Account Statements: Frequently check your bank statements for any unauthorized transactions.

- Set Up Account Alerts: Enable notifications for account activities to stay informed about any changes or transactions.

- Report Suspicious Activity Immediately: If you notice any irregularities, contact your bank promptly to address the issue.

5. Educate Yourself Continuously

- Stay Informed About Common Scams: Learn about prevalent fraud schemes in Nigeria to recognize and avoid them.

- Participate in Financial Literacy Programs: Engage in workshops or online courses that enhance your understanding of digital banking security.

- Share Knowledge: Educate family and friends about safe banking practices to foster a community of informed users.

By implementing these best practices, you can significantly reduce the risk of falling victim to digital banking fraud. Remember, staying informed and vigilant is your first line of defense in the ever-evolving landscape of cyber threats.

Let’s face it—living in a digital-first Nigeria means your banking habits are no longer just personal; they’re also increasingly vulnerable. The moment you tap “Send” or check your balance on a mobile app, you’re part of a massive, interconnected fintech ecosystem that’s growing fast—and so are the threats that come with it.

If you’re someone who prefers to think twice before hitting “Confirm,” that’s not paranoia; it’s wisdom. Being financially cautious doesn’t mean living in fear. It means staying informed, adopting smart habits, and knowing what to look out for.

We’ve walked through how Nigeria’s fintech boom has transformed everyday banking, but also how fraudsters have taken advantage of the same digital tools. We’ve looked at real figures that prove fraud is on the rise, explored the robust regulatory responses from institutions like the Central Bank of Nigeria and the Nigeria Electronic Fraud Forum, and broken down the practical things you can do—right now—to keep your money safe.

So here’s your next step: don’t just read and nod. Take action. Update your app settings, enable two-factor authentication, and double-check the messages you receive. Share what you’ve learned with people you care about. Because security in the digital age isn’t just about software updates—it’s also about spreading awareness.

You don’t have to be an expert in cybersecurity to protect yourself. You just need to be alert, informed, and proactive. And in today’s Nigeria, that mindset is one of your most valuable financial tools.

Stay sharp. Stay cautious. Stay safe.