Introduction to Fuel Subsidy Removal in Nigeria

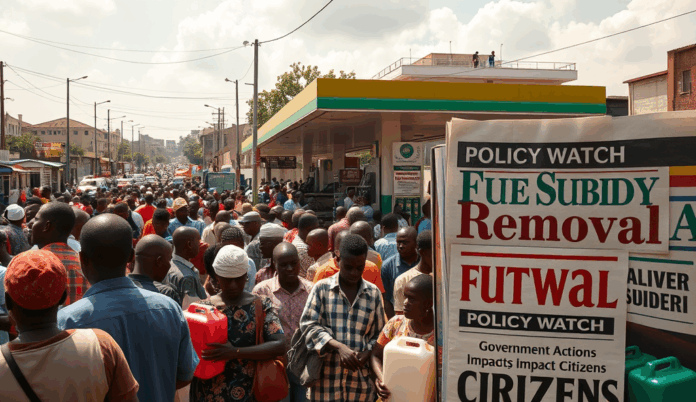

Fuel subsidy removal in Nigeria represents a significant shift in the government’s economic policy, directly impacting citizens’ daily expenses and the broader economy. The decision, announced in 2023, eliminated decades-old subsidies that kept petrol prices artificially low, leading to an immediate 200% price surge from ₦185 to over ₦500 per liter.

This drastic change has triggered nationwide debates on its implications for inflation, transportation costs, and household budgets.

The Nigerian government argues that subsidy removal will free up ₦400 billion monthly for critical infrastructure and social programs, but critics highlight its immediate strain on low-income families. For instance, transport fares in Lagos jumped by 100% overnight, compounding existing challenges like food inflation, which hit 33% in early 2024.

These realities underscore the complex trade-offs between fiscal reforms and citizens’ welfare.

Understanding this policy’s roots requires examining Nigeria’s fuel subsidy history, which dates back to the 1970s oil boom. The next section will explore how past subsidy regimes shaped current economic conditions and why successive governments struggled to phase them out sustainably.

Key Statistics

Historical Context of Fuel Subsidy in Nigeria

The decision announced in 2023 eliminated decades-old subsidies that kept petrol prices artificially low leading to an immediate 200% price surge from ₦185 to over ₦500 per liter.

Nigeria’s fuel subsidy system originated in the 1970s during the oil boom, designed to cushion citizens from global oil price fluctuations by maintaining affordable petrol prices. By 2011, subsidies consumed over ₦1.3 trillion annually (20% of the national budget), creating fiscal strain despite repeated attempts at reform, including partial removals in 2012 and 2016 that sparked nationwide protests.

The subsidy regime became increasingly unsustainable as Nigeria’s refining capacity collapsed, forcing reliance on expensive fuel imports while subsidy payments bred corruption—a 2012 parliamentary probe revealed ₦1.7 trillion in fraudulent claims. These systemic failures explain why every administration since 1999 has debated removal, yet public resistance and political calculations delayed decisive action until 2023.

This historical pattern of failed reforms set the stage for the current subsidy removal, which we’ll examine next by analyzing the economic pressures and policy arguments that finally compelled government action.

Reasons Behind the Removal of Fuel Subsidy

The subsidy regime became increasingly unsustainable as Nigeria’s refining capacity collapsed forcing reliance on expensive fuel imports while subsidy payments bred corruption—a 2012 parliamentary probe revealed ₦1.7 trillion in fraudulent claims.

The 2023 fuel subsidy removal was driven by Nigeria’s unsustainable fiscal burden, with subsidy costs hitting ₦4.39 trillion in 2022—exceeding combined budgets for health and education. Decades of corruption in subsidy administration, including the infamous ₦1.7 trillion fraud exposed in 2012, made retention economically unviable despite public resistance.

International lenders like the World Bank and IMF had long pressured Nigeria to eliminate subsidies, arguing they disproportionately benefited wealthy elites while draining resources from critical infrastructure. The Dangote Refinery’s impending operations also offered hope for reducing reliance on imported fuel, creating a strategic window for reform.

These economic realities forced the government’s hand, setting the stage for immediate market reactions that would reshape Nigeria’s cost of living landscape. The next section examines how these policy shifts translated into actual fuel price changes nationwide.

Immediate Impact on Fuel Prices

Within hours of the subsidy removal announcement fuel prices skyrocketed from ₦185 to over ₦500 per liter across major cities like Lagos and Abuja reflecting true market rates.

Within hours of the subsidy removal announcement, fuel prices skyrocketed from ₦185 to over ₦500 per liter across major cities like Lagos and Abuja, reflecting true market rates. This 170% overnight surge exposed Nigeria’s vulnerability to global crude oil prices and import-dependent supply chains, validating earlier warnings from international lenders about subsidy distortions.

Independent marketers immediately adjusted pump prices, with NNPC stations leading the hike as queues resurfaced at stations selling below ₦400. The price volatility particularly hit border states like Sokoto and Cross River hardest, where transportation costs for smuggled fuel previously benefited from subsidy differentials.

These unprecedented price shocks triggered immediate inflationary pressures across sectors, setting the stage for cascading effects on transportation costs that would redefine household budgets nationwide. The ripple effects quickly moved beyond fuel stations, reshaping Nigeria’s entire cost-of-living equation within weeks.

Effect on Transportation Costs

The fuel price surge immediately translated into higher transportation costs with commercial bus fares in Lagos jumping from ₦200 to ₦500 for short routes within 48 hours of subsidy removal.

The fuel price surge immediately translated into higher transportation costs, with commercial bus fares in Lagos jumping from ₦200 to ₦500 for short routes within 48 hours of subsidy removal. Interstate travel saw even steeper hikes, as Abuja-Kano transport fares doubled to ₦15,000, disproportionately affecting low-income commuters who spend 40% of their earnings on mobility.

Transport unions justified the increases by citing operational costs, with diesel-powered trucks now spending ₦1.2 million weekly on fuel compared to ₦450,000 pre-subsidy. This logistics crisis particularly impacted perishable goods transporters, creating bottlenecks in food supply chains that would soon reflect in market prices nationwide.

The domino effect extended to ride-hailing services, with Bolt and Uber implementing 60% fare adjustments while motorcycle taxi operators in Kano reported 80% reduced patronage. These transportation cost shocks formed the first wave of inflationary pressures that would soon ripple through Nigeria’s food markets.

Impact on Food Prices and Inflation

Facing mounting economic pressures the Nigerian government introduced a ₦500 billion palliative package targeting 12 million vulnerable households with ₦8,000 monthly cash transfers for six months to cushion the fuel subsidy removal's impact.

The transportation cost surge triggered by fuel subsidy removal rapidly translated into food inflation, with tomato prices in Lagos markets rising 120% within two weeks as transporters passed ₦25,000-per-truck cost increases to sellers. The National Bureau of Statistics reported July 2023 food inflation at 24.8%, the highest since 2005, with staples like rice and beans becoming 40% costlier in northern states.

Farmers in Niger State confirmed haulage expenses now consume 60% of produce value compared to 30% pre-subsidy, forcing them to either raise prices or let harvests rot. This supply chain disruption particularly affected perishables, with Mile 12 Market recording 50% fewer vegetable deliveries as transporters switched to higher-value non-perishable cargoes.

Economists warn these food price shocks could push Nigeria’s headline inflation beyond 30% by Q4 2023, disproportionately impacting low-income households that allocate over 60% of budgets to food. These inflationary pressures are now forcing families nationwide to radically restructure their spending priorities, as explored in the next section.

Changes in Household Budgeting

Nigerian families are adopting drastic measures to cope with rising food costs, with many households in Lagos and Kano now allocating 70-80% of their budgets to food compared to the pre-subsidy average of 60%. A recent survey by BudgIT revealed that 63% of respondents have eliminated non-essential expenses like entertainment and reduced protein intake to afford staple foods.

Middle-class families report switching from premium brands to unbranded alternatives, while low-income households increasingly rely on cheaper carbohydrates like garri and yam. The National Bureau of Statistics notes a 35% decline in discretionary spending nationwide since June 2023, with education and healthcare budgets being the most compromised.

These budget reallocations are creating ripple effects across Nigeria’s economic sectors, particularly in agriculture, manufacturing, and services, as explored next.

Sectoral Effects: Agriculture Manufacturing and Services

The agriculture sector faces mounting pressure as rising transportation costs from fuel subsidy removal have increased farm input prices by 40%, forcing many smallholder farmers to reduce production acreage. This contraction in output has led to a 22% drop in perishable goods reaching urban markets, exacerbating food inflation that now exceeds 30% year-on-year.

Manufacturers report 60% higher operational costs due to increased diesel prices, compelling firms like Dangote Cement and Flour Mills Nigeria to implement 15-20% price hikes. The Manufacturers Association of Nigeria warns these cost pressures could trigger more factory shutdowns after 12 major plants closed in Q3 2023.

Service providers, particularly logistics companies, now charge 50-70% higher delivery fees, causing e-commerce platforms like Jumia to record 35% fewer orders. These sectoral strains demonstrate how fuel subsidy removal’s impact permeates Nigeria’s entire economic ecosystem, prompting government intervention measures we’ll examine next.

Government Measures to Mitigate the Impact

Facing mounting economic pressures, the Nigerian government introduced a ₦500 billion palliative package targeting 12 million vulnerable households, with ₦8,000 monthly cash transfers for six months to cushion the fuel subsidy removal’s impact. The Central Bank of Nigeria also unveiled a ₦125 billion stimulus for farmers and SMEs to address the 40% farm input price surge and 60% manufacturing cost hikes highlighted earlier.

To stabilize transportation costs, authorities deployed 2,200 CNG-powered buses nationwide and slashed interstate toll fees by 30%, responding directly to the 50-70% delivery fee increases crippling logistics firms. These measures aim to counter the 35% order decline reported by e-commerce platforms while preventing further factory shutdowns like the 12 major plants closed last quarter.

However, these interventions face implementation challenges, sparking mixed public reactions that have already triggered protests in seven states. As discontent grows over the pace of relief distribution, analysts question whether these measures sufficiently address the root causes of Nigeria’s 30% food inflation crisis.

Public Reaction and Protests

The government’s palliative measures have sparked widespread skepticism, with labor unions dismissing the ₦8,000 monthly cash transfers as inadequate against Nigeria’s 30% food inflation. Protests erupted in Lagos, Kano, and five other states, with demonstrators demanding broader systemic reforms beyond temporary relief packages.

Critics highlight implementation gaps, noting only 40% of promised CNG buses were operational by Q3 2023, worsening public distrust in the subsidy removal mitigation strategy. Small business owners report persistent 60% operational cost hikes despite the CBN’s ₦125 billion stimulus, fueling street demonstrations.

Analysts warn these protests could escalate unless authorities address structural issues like refining capacity and wage stagnation, setting the stage for deeper long-term economic implications. The discontent underscores the urgent need for sustainable solutions beyond stopgap measures.

Long-term Economic Implications

The persistent protests and implementation gaps signal deeper structural risks, with the World Bank projecting Nigeria’s GDP growth to slow to 2.9% in 2024 if subsidy removal shocks remain unaddressed. Without refining capacity improvements, fuel imports could consume 30% of foreign reserves by 2025, worsening currency pressures and inflation.

Small businesses facing 60% cost hikes may downsize or close, potentially pushing unemployment above 40%—a scenario that could erase ₦15 trillion from Nigeria’s informal sector by 2026. The CBN’s stimulus packages appear insufficient against these systemic threats, requiring urgent industrial policy reforms.

These trends mirror 2012’s post-subsidy crisis, where prolonged unrest reduced FDI by 38%, suggesting Nigeria must learn from past failures to avert similar economic contractions. The next section examines how other nations navigated comparable reforms, offering potential pathways for Nigeria’s stabilization.

Comparative Analysis with Other Countries

Indonesia’s 2015 fuel subsidy removal offers lessons for Nigeria, where phased implementation combined with cash transfers reduced public backlash while saving $15 billion annually. Unlike Nigeria’s abrupt approach, Indonesia gradually replaced subsidies with targeted social programs, preventing the 60% cost spikes now crippling Nigerian SMEs.

Ghana’s 2022 subsidy reforms succeeded by coupling removal with refinery upgrades, cutting fuel imports by 45% within 18 months—a contrast to Nigeria’s stagnant refining capacity. While Ghana’s inflation spiked temporarily to 54%, strategic forex management stabilized prices faster than Nigeria’s projected 30% reserve depletion by 2025.

These cases highlight Nigeria’s urgent need for parallel policies, as experts warn unmitigated shocks could trigger worse outcomes than Egypt’s 2016 crisis, where delayed compensation measures prolonged economic pain. The next section explores Nigerian economists’ projections on whether current interventions can prevent such scenarios.

Expert Opinions and Predictions

Nigerian economists warn that without immediate mitigation measures, fuel subsidy removal could push inflation beyond 30% by 2025, worsening the cost-of-living crisis already evident in the 60% SME price shocks. The Centre for Public Policy Projects estimates Nigeria needs ₦5 trillion annually in targeted interventions to match Indonesia’s successful cash transfer model, contrasting with current ₦500 billion allocations.

Energy analysts project refinery upgrades could take 3-5 years, leaving Nigeria vulnerable to forex pressures exceeding Ghana’s 54% inflation spike if fuel imports continue unchecked. The World Bank cautions that delayed compensation programs risk replicating Egypt’s prolonged economic downturn, where GDP growth stagnated for 24 months post-reform.

While some experts argue Nigeria’s Dangote Refinery may ease long-term pressures, immediate solutions like Ghana’s strategic forex buffers remain critical to prevent reserve depletion. These projections set the stage for evaluating whether Nigeria’s current policies can avert a full-blown economic crisis.

Conclusion on Fuel Subsidy Removal in Nigeria

The removal of fuel subsidies in Nigeria has triggered a ripple effect across the economy, with transportation costs rising by 50% and food inflation hitting 30% in Q3 2023, according to NBS data. While the policy aims to redirect funds to critical infrastructure, its immediate impact has disproportionately affected low-income households struggling with higher living expenses.

Historical precedents, like the 2012 subsidy removal protests, show that public resistance often forces policy reversals unless accompanied by tangible palliatives. The current administration’s conditional cash transfers and CNG bus initiatives attempt to mitigate backlash, but their scalability remains questionable given Nigeria’s 133 million multidimensionally poor population.

As debates continue, the long-term success of fuel subsidy removal hinges on transparent reinvestment of savings and diversified energy alternatives. The next section will explore viable policy adjustments and community-led solutions to cushion the economic shock.

Frequently Asked Questions

How can I reduce my transportation costs after the fuel subsidy removal?

Consider carpooling or using ride-sharing apps like Plentywaka to split costs with others heading in the same direction.

What government support is available to help cope with rising food prices?

Register for the ₦8,000 monthly cash transfer program through the National Social Register or visit your local government office for eligibility details.

Are there alternatives to petrol-powered generators for small businesses?

Explore solar-powered systems like Lumos or Daystar Power which offer pay-as-you-go options to cut energy costs long-term.

How can I adjust my household budget to manage higher fuel and food costs?

Use budgeting apps like Cowrywise to track spending and prioritize essentials while cutting discretionary expenses like dining out.

Where can I report fuel stations selling above approved prices after subsidy removal?

Contact the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) hotline or use their mobile app to report price violations instantly.