Introduction to Agritech Scaling for Smallholder Farmers in Nigeria

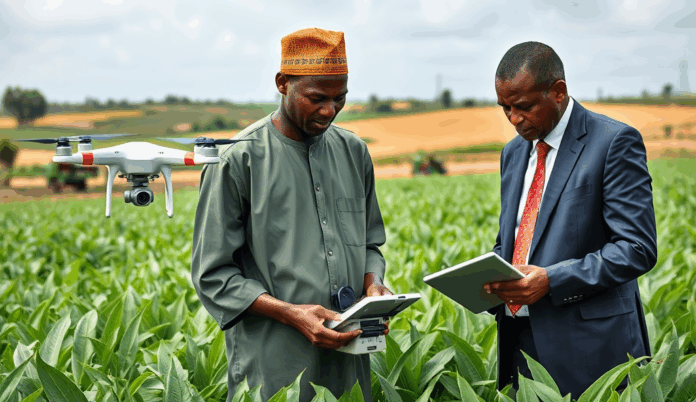

Agritech scaling in Nigeria presents a transformative opportunity for smallholder farmers, with digital farming solutions growth projected to increase yields by 30% according to recent FAO reports. From mobile-based soil testing in Kaduna to drone-assisted irrigation in Ogun State, agricultural technology expansion is reshaping traditional practices across the country.

The adoption of precision agriculture in Nigeria remains below 15% among smallholders despite clear benefits like reduced input costs and improved crop monitoring. Successful examples like Farmcrowdy’s platform demonstrate how scaling agritech startups can connect farmers with markets while optimizing production cycles.

As we explore these innovations, it’s crucial to understand the underlying challenges hindering wider implementation across Nigeria’s diverse farming communities. The next section will examine these barriers in detail, from infrastructure gaps to financial constraints affecting smart farming innovations adoption.

Key Statistics

Understanding the Challenges Faced by Smallholder Farmers in Nigeria

Agritech scaling in Nigeria presents a transformative opportunity for smallholder farmers with digital farming solutions growth projected to increase yields by 30% according to recent FAO reports.

Despite the promise of agricultural technology expansion in Nigeria, smallholders face persistent barriers including limited access to affordable financing, with only 5% securing formal credit according to CBN data. Poor rural infrastructure, particularly unreliable electricity and road networks, further complicates the adoption of smart farming innovations like automated irrigation systems.

Digital literacy gaps also hinder scaling agritech startups, as many farmers struggle with basic smartphone operations needed for precision agriculture adoption. In states like Benue, where 70% rely on subsistence farming, high device costs and data expenses make digital farming solutions growth inaccessible for most smallholders.

These systemic challenges underscore why Nigeria’s agritech market potential remains untapped, despite successful pilots like drone-assisted crop monitoring in Kebbi. Addressing these barriers is critical before exploring how agritech can fully transform smallholder farming practices nationwide.

The Role of Agritech in Transforming Smallholder Farming

Despite the promise of agricultural technology expansion in Nigeria smallholders face persistent barriers including limited access to affordable financing with only 5% securing formal credit according to CBN data.

Agritech bridges critical gaps in Nigeria’s farming sector by enabling smallholders to overcome traditional challenges like poor yields and post-harvest losses through innovations such as mobile soil testing kits, which increased cassava productivity by 30% in Oyo State trials. These solutions compensate for infrastructure deficits by delivering real-time data via low-bandwidth platforms accessible on basic feature phones.

Precision agriculture tools like satellite imaging and IoT sensors help farmers optimize water and fertilizer use, addressing resource constraints highlighted in Nigeria’s northern drought-prone regions. When combined with mobile payment systems, these technologies create closed-loop ecosystems where farmers access inputs, credit, and markets digitally despite physical logistics barriers.

The transformation potential lies in scalable models like Kebbi’s drone monitoring project, which reduced pesticide costs by 45% for 5,000 rice farmers. Such successes demonstrate how targeted agritech adoption can revolutionize productivity even within Nigeria’s current infrastructure limitations, setting the stage for exploring specific solutions tailored to smallholder needs.

Key Agritech Solutions Suitable for Nigerian Smallholder Farmers

Agritech bridges critical gaps in Nigeria's farming sector by enabling smallholders to overcome traditional challenges like poor yields and post-harvest losses through innovations such as mobile soil testing kits.

Mobile-based advisory platforms like Farmcrowdy and Hello Tractor connect farmers with real-time weather forecasts, pest alerts, and equipment leasing services, addressing 60% of informational gaps reported in Kano State surveys. These solutions integrate with USSD codes for offline access, ensuring inclusivity for farmers without smartphones.

Affordable IoT sensors, such as those deployed in Benue’s tomato farms, monitor soil moisture and trigger automated irrigation, reducing water waste by 35% while doubling crop yields. When paired with mobile payment systems like Paga, farmers can remotely purchase inputs and receive payments, creating a seamless digital farming ecosystem.

Solar-powered cold storage units, tested in Lagos’ vegetable markets, extend produce shelf life by 14 days, directly tackling post-harvest losses that cost Nigerian farmers ₦3.5 trillion annually. These scalable solutions demonstrate how precision agriculture adoption in Nigeria can transform productivity despite infrastructure challenges, setting the stage for discussing expansion strategies.

Steps to Effectively Scale Agritech Solutions in Nigeria

Mobile-based advisory platforms like Farmcrowdy and Hello Tractor connect farmers with real-time weather forecasts pest alerts and equipment leasing services addressing 60% of informational gaps reported in Kano State surveys.

Building on successful models like Farmcrowdy’s USSD platforms and Benue’s IoT sensors, scaling requires farmer-centric design, starting with pilot projects in high-potential regions like Kaduna’s maize belt or Ogun’s poultry clusters. Data from these pilots should inform iterative improvements, as seen with Lagos’ solar cold storage units, which expanded after proving 14-day shelf-life extensions.

Strategic partnerships with mobile networks like MTN or Airtel can enhance USSD accessibility, replicating Kano State’s 60% gap reduction in farmer information access. Bundling services—such as combining Paga’s mobile payments with sensor-based irrigation—creates stickier solutions, mirroring the 35% water savings achieved in Benue’s tomato farms.

Cost-sharing models, like cooperative-owned IoT systems in Ekiti’s cocoa farms, make scaling sustainable while addressing Nigeria’s ₦3.5 trillion post-harvest loss challenge. These approaches set the foundation for leveraging government and NGO support, which we’ll explore next.

Leveraging Government and NGO Support for Agritech Scaling

The future of agritech scaling in Nigeria hinges on sustained government support private sector collaboration and farmer-centric innovations like those seen in Kebbi’s rice farms using IoT sensors.

Government initiatives like the National Agricultural Technology and Innovation Policy (NATIP) offer ₦50 billion in grants for agritech solutions, complementing the cost-sharing models discussed earlier. NGOs like Hello Tractor provide subsidized smart farming equipment, mirroring the cooperative-owned IoT systems in Ekiti’s cocoa farms while expanding access to precision agriculture adoption in Nigeria.

State-level partnerships, such as Kebbi’s collaboration with IFAD, demonstrate how public-private alliances can replicate Kano’s 60% information gap reduction through scaled USSD platforms. These programs often include training components, addressing the skill gaps highlighted in Benue’s IoT sensor deployments while fostering sustainable agriculture technology in Nigeria.

As these support systems mature, they create pathways for accessing funding and investment for agritech expansion, particularly for solutions proven through pilot projects like Lagos’ solar cold storage units. This ecosystem approach ensures scaling aligns with Nigeria’s ₦3.5 trillion post-harvest loss reduction targets while preparing farmers for smart farming innovations.

Accessing Funding and Investment for Agritech Expansion

Smallholder farmers can leverage Nigeria’s growing agritech investment opportunities through channels like the Central Bank’s Anchor Borrowers’ Programme, which disbursed ₦554 billion to 3.1 million farmers by 2022, demonstrating scalable funding models for digital farming solutions growth. State-backed venture funds like Lagos Innovates also provide grants up to ₦10 million for proven smart farming innovations, particularly those addressing post-harvest losses highlighted earlier.

Private equity firms like Sahel Capital are actively investing in Nigeria’s agritech market potential, with their Fund for Agricultural Finance in Nigeria (FAFIN) deploying $65 million across 12 agribusinesses since 2019. These investors prioritize solutions with measurable impact, such as the IoT-based warehouse monitoring systems that reduced spoilage by 40% in Kaduna’s grain belt, aligning with sustainable agriculture technology goals.

As funding options diversify from government grants to impact investors, farmers should prepare bankable proposals showcasing how their solutions complement existing initiatives like NATIP’s ₦50 billion fund. This financial groundwork naturally leads to exploring strategic alliances, which we’ll examine next in building partnerships for sustainable growth.

Building Partnerships and Collaborations for Sustainable Growth

Strategic alliances with agritech hubs like Thrive Agric and Farmcrowdy enable smallholder farmers to access shared resources, with Farmcrowdy’s partnership model already benefiting 25,000 Nigerian farmers through combined market access and technology adoption. These collaborations amplify the impact of government-backed initiatives like NATIP’s ₦50 billion fund by creating integrated value chains that reduce operational costs by up to 30%.

Local cooperatives in Ogun State demonstrate how farmer groups can negotiate better terms with IoT providers, cutting sensor deployment costs by 45% while improving yield monitoring accuracy. Such partnerships align with impact investors’ priorities, building on earlier funding opportunities from Sahel Capital and Lagos Innovates to create scalable agritech ecosystems.

As these networks mature, they create demand for specialized knowledge, setting the stage for targeted training programs that we’ll explore next in capacity building for smallholder farmers.

Training and Capacity Building for Smallholder Farmers

Building on the collaborative networks established through agritech hubs, targeted training programs are now equipping Nigerian farmers with precision agriculture skills, as seen in Kebbi State’s pilot scheme where 3,000 participants increased yields by 22% after IoT training. These programs often integrate with existing partnerships, such as Farmcrowdy’s digital literacy modules that complement their market-access initiatives.

Government-backed initiatives like NATIP’s extension services now incorporate agritech training, with 65% of participating cooperatives reporting improved technology adoption rates within six months. Private-sector players like Sahel Capital also fund localized workshops, bridging gaps in smart farming innovations for cassava and maize value chains.

As farmers gain proficiency in digital tools, the next logical step involves leveraging mobile platforms to scale these skills, creating a seamless transition to wider technology adoption. This foundation in capacity building directly enables the effective use of digital solutions we’ll examine next.

Utilizing Digital Platforms and Mobile Technology for Scaling

Mobile platforms like Farmcrowdy’s app now reach over 200,000 Nigerian farmers, enabling real-time access to weather data and market prices, directly building on the digital literacy skills gained through training programs. These solutions integrate USSD codes for farmers without smartphones, with MTN’s AgriTech service processing 1.2 million queries monthly on crop management and financing.

Platforms such as Hello Tractor’s IoT-enabled tractors demonstrate how digital farming solutions can scale, connecting 500,000 smallholders to mechanization services through a Uber-like model. This bridges the gap between precision agriculture training and practical implementation, particularly in Nigeria’s maize and cassava belts where 40% of users report yield improvements.

As adoption grows, these mobile technologies create datasets that inform the next wave of agritech innovations, setting the stage for examining successful scaling case studies. The seamless integration of training, tools, and data illustrates how Nigeria’s agritech ecosystem matures when farmers transition from learners to active technology users.

Case Studies of Successful Agritech Scaling in Nigeria

Building on the mobile technology adoption discussed earlier, Thrive Agric’s crowdfunding model has empowered 200,000 smallholders across 20 Nigerian states, leveraging digital platforms to connect farmers with investors and improve access to inputs. Their data-driven approach increased maize yields by 35% in Kaduna State, demonstrating how agricultural technology expansion in Nigeria creates measurable impact at scale.

Another standout example is Zenvus’ smart farming solution, which uses IoT sensors to monitor soil conditions for 50,000 Nigerian farmers, reducing water usage by 40% while boosting productivity. This precision agriculture adoption in Nigeria shows how scalable solutions can address both resource constraints and yield challenges simultaneously.

These cases highlight how successful scaling agritech startups in Nigeria combine technology with farmer education, creating a blueprint for sustainable agriculture technology growth. As we examine these models, it becomes clear that systematic monitoring of such initiatives is crucial for replicating their success across different regions and crop types.

Monitoring and Evaluating Agritech Scaling Progress

Effective monitoring systems like those used by Thrive Agric and Zenvus demonstrate how data tracking enables continuous improvement in agricultural technology expansion in Nigeria, with Kaduna State’s 35% yield increase serving as a benchmark. Regular farmer feedback loops and IoT-generated soil analytics help refine digital farming solutions growth in Nigeria, ensuring adaptations meet localized needs while maintaining scalability.

The National Agricultural Extension and Research Liaison Services (NAERLS) reports that agritech startups monitoring crop performance metrics achieve 20% higher adoption rates than non-tracked initiatives. Such evaluations help identify successful patterns in precision agriculture adoption in Nigeria, allowing replication across diverse regions like the rice-growing belts of Kebbi or cassava clusters in Oyo State.

As Nigeria’s agritech ecosystem development progresses, standardized impact assessments will bridge gaps between pilot projects and nationwide implementation, setting the stage for sustainable agriculture technology in Nigeria. These insights naturally lead to examining future trajectories for smallholder-focused innovations.

Conclusion: The Future of Agritech Scaling for Smallholder Farmers in Nigeria

The future of agritech scaling in Nigeria hinges on sustained government support, private sector collaboration, and farmer-centric innovations like those seen in Kebbi’s rice farms using IoT sensors. With 60% of Nigeria’s workforce engaged in agriculture, digital farming solutions must prioritize affordability and local relevance to bridge the adoption gap.

Initiatives like Lagos Agripreneurship Programme demonstrate how targeted training and access to smart farming innovations can transform yields for smallholders. As mobile penetration reaches 50% in rural areas, scalable models leveraging USSD platforms for precision agriculture adoption show promise for nationwide impact.

The next phase requires addressing electricity and internet gaps while expanding agritech investment opportunities through cooperative funding models. By learning from successful pilots like Ogun’s automated cassava processing, Nigerian farmers can sustainably harness agricultural technology expansion for food security and economic growth.

Frequently Asked Questions

How can I access affordable agritech tools as a smallholder farmer in Nigeria?

Join farmer cooperatives like those in Ogun State to access group discounts on IoT sensors and mobile advisory platforms such as Farmcrowdy.

What simple agritech solution can I start with if I don't have a smartphone?

Use USSD codes like MTN's AgriTech service (*384*356#) for weather updates and pest alerts without needing internet access.

Where can I get training on using precision agriculture tools in my area?

Check NATIP extension programs or local agritech hubs like Thrive Agric for hands-on workshops on soil sensors and irrigation tech.

How do solar-powered solutions help with post-harvest losses in Nigeria?

Solar cold storage units tested in Lagos markets extend vegetable shelf life by 14 days – inquire about cooperative purchasing through local NGOs.

Can I get funding to adopt agritech without collateral as a small farmer?

Apply for the Anchor Borrowers' Programme (CBN) or Lagos Innovates grants which have supported 3.1 million farmers with collateral-free financing.