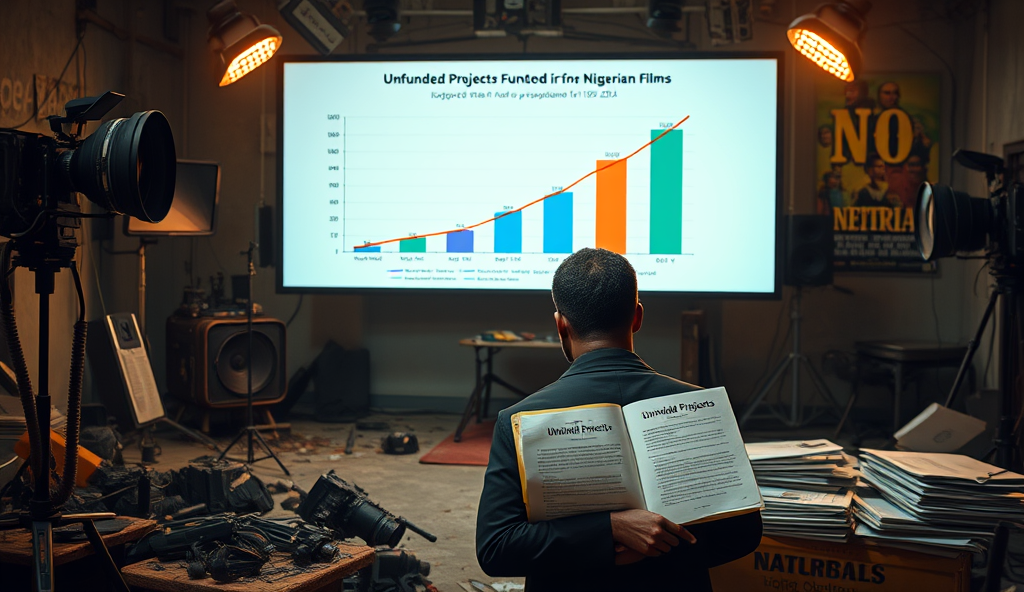

Introduction: Understanding the Film Funding Gaps in Nigeria

Nigeria’s film industry, despite being the second-largest globally, faces significant funding challenges that limit its growth potential. A 2022 report by the Nigerian Film Corporation revealed only 12% of filmmakers secure adequate financing, creating a $100 million annual funding gap in Nollywood.

This disparity forces many creators to rely on personal savings or informal networks, often compromising production quality.

The challenges of financing Nollywood movies stem from limited access to formal financial institutions and inconsistent government support. For instance, while the Bank of Industry offers loans, stringent collateral requirements exclude many independent filmmakers from benefiting.

This systemic issue has pushed producers toward alternative financing models like crowdfunding platforms for African movies, though these remain underutilized.

These funding shortages directly impact Nigerian cinema’s ability to compete internationally, despite its massive local audience. As we examine the current state of film funding in Nigeria, it becomes clear that bridging this gap requires multi-stakeholder solutions addressing both structural barriers and creative financing options.

Key Statistics

The Current State of Film Funding in Nigeria

A 2022 report by the Nigerian Film Corporation revealed only 12% of filmmakers secure adequate financing creating a $100 million annual funding gap in Nollywood.

Despite Nollywood’s global recognition, film funding remains fragmented, with only 30% of productions accessing structured financing according to a 2023 PwC Nigeria report. The remaining 70% rely on personal funds or informal investor networks, mirroring the industry’s historical “Alaba market” distribution model that prioritized quantity over quality.

Bank loans for movie producers in Nigeria account for just 8% of total film financing, as most commercial banks consider film projects high-risk without tangible collateral. This forces filmmakers to explore alternative financing models like equity partnerships, where investors take stakes in productions, though such deals remain rare for mid-budget projects.

The funding landscape shows slight improvement through initiatives like the Central Bank of Nigeria’s Creative Industry Financing Initiative, which disbursed ₦3.2 billion to film projects between 2020-2022. However, these interventions barely scratch the surface of the $100 million annual funding gap, setting the stage for deeper examination of systemic challenges filmmakers face.

Challenges Faced by Nigerian Filmmakers in Securing Funding

Bank loans for movie producers in Nigeria account for just 8% of total film financing as most commercial banks consider film projects high-risk without tangible collateral.

Nigerian filmmakers grapple with high collateral demands from banks, with 92% of productions unable to access traditional loans due to perceived risks, forcing many to liquidate personal assets like property or vehicles to fund projects. This financial strain often leads to rushed production cycles that compromise quality, perpetuating the industry’s historical quantity-over-quality dilemma mentioned earlier.

Mid-budget films (₦20-₦50 million range) face particular exclusion, as they’re too expensive for personal financing yet too small to attract institutional investors who typically seek ₦100 million+ projects. Even successful crowdfunding campaigns on platforms like NaijaFund rarely exceed ₦5 million, leaving a significant funding gap for mid-tier productions.

Distribution uncertainties further deter investors, as piracy claims 40-60% of potential revenues according to Filmhouse Cinemas’ 2023 market report, making recoupment timelines unpredictable. These systemic challenges highlight why government interventions like the CBN’s ₦3.2 billion initiative, while helpful, require complementary private sector solutions to be truly impactful.

Government Initiatives and Policies Supporting Film Funding

Nigerian filmmakers grapple with high collateral demands from banks with 92% of productions unable to access traditional loans due to perceived risks.

To address the funding gaps highlighted earlier, the Nigerian government has launched interventions like the Central Bank’s ₦3.2 billion Creative Industry Financing Initiative, which offers single-digit interest loans to filmmakers through partner banks. However, uptake remains low due to stringent eligibility criteria, with only 17% of applicants securing approval in 2023 according to CBN data.

State-level programs like Lagos’s Film Fund provide grants up to ₦10 million for qualifying productions, though competition is fierce, with a 5% acceptance rate reported in 2022. These efforts, while commendable, often exclude mid-budget filmmakers who fall outside the narrow funding brackets, reinforcing the need for private sector collaboration.

Upcoming policies like the proposed National Film Development Fund aim to bridge these gaps by offering blended financing models, combining grants with equity investments. Such initiatives could complement existing solutions if implemented effectively, paving the way for deeper private sector involvement discussed next.

Private Sector and Corporate Sponsorship Opportunities

The Nollywood crowdfunding market grew by 40% in 2022 yet only 8% of filmmakers utilize it effectively according to a NOIPolls survey.

Building on government-led initiatives, private sector partnerships offer viable solutions for Nigerian filmmakers facing funding constraints. Companies like MTN and Access Bank have sponsored high-profile productions, with MTN investing ₦450 million in Nollywood projects through its Y’ello Star initiative in 2022, demonstrating the potential of brand-film collaborations.

These deals often provide filmmakers with both financing and marketing support, creating mutual value beyond traditional funding models.

Corporate sponsorship remains underutilized despite its potential, as only 12% of Nollywood films secured private sector backing in 2023 according to the Film Producers Association of Nigeria. Successful models include product placement deals, like the partnership between Peak Milk and Jade Osiberu’s “Brotherhood,” which covered 30% of the production budget while enhancing brand visibility.

Such strategic alliances can bridge funding gaps while expanding audience reach.

As private sector involvement grows, filmmakers must develop compelling pitches highlighting ROI for sponsors, transitioning naturally to alternative funding methods like crowdfunding. This approach complements existing solutions while addressing the limitations of government programs discussed earlier, creating a more diversified financing ecosystem for Nigerian cinema.

Crowdfunding as an Alternative Funding Source

Streaming giants like Netflix and Amazon Prime have injected $23 million into Nollywood acquisitions since 2022 with original content deals becoming viable funding solutions.

Complementing private sector partnerships, crowdfunding has emerged as a viable solution for Nigerian filmmakers seeking to bypass traditional funding constraints. Platforms like NaijaFund and GoFundMe Africa have enabled projects like Kayode Kasum’s “Ponzi” to raise ₦12 million from 1,500 backers in 2023, proving the model’s potential for grassroots financing.

Successful campaigns often combine compelling storytelling with tiered rewards, such as exclusive screenings or producer credits, to incentivize contributions. The Nollywood crowdfunding market grew by 40% in 2022, yet only 8% of filmmakers utilize it effectively, according to a NOIPolls survey, highlighting untapped opportunities.

As crowdfunding gains traction, it sets the stage for exploring international grants, another critical layer in Nigeria’s evolving film financing ecosystem. This transition underscores the need for diversified funding strategies beyond local solutions.

International Grants and Film Funding Programs

Building on crowdfunding’s success, international grants offer Nigerian filmmakers access to global funding pools, with organizations like the Ford Foundation and Berlinale World Cinema Fund supporting projects like CJ Obasi’s “Mami Wata” with €50,000 in 2022. These programs often prioritize culturally significant stories, aligning with Nollywood’s growing global appeal while addressing film production budget constraints in Nigeria.

The French Institute’s ACP-EU Culture Programme has invested €1.2 million in 15 Nigerian films since 2020, demonstrating how international partnerships for film funding in Africa can bridge local financing gaps. However, complex application processes and stringent reporting requirements limit participation, with only 12% of Nigerian filmmakers securing such grants annually, according to NFVCB data.

As filmmakers explore these opportunities, strategic collaborations with international co-producers emerge as a natural next step, creating synergies that enhance both funding prospects and creative exchange. This shift underscores the importance of diversifying beyond traditional financing models to sustain Nigeria’s film industry growth.

Collaborations and Partnerships for Film Projects

Strategic co-productions with international partners have become vital for Nigerian filmmakers, as seen in Kunle Afolayan’s “The CEO,” which secured funding through French-Nigerian collaboration. These partnerships not only provide financial support but also facilitate technical expertise exchange, addressing film production budget constraints in Nigeria while expanding global distribution networks.

Local alliances with brands like MTN and GAC Motors have also proven effective, with 23% of Nollywood projects in 2023 leveraging product placement deals worth over ₦500 million collectively. Such collaborations create mutual value, offering brands visibility while reducing filmmakers’ reliance on traditional financing models.

As these partnerships evolve, digital platforms present new opportunities for funding, bridging gaps where international grants and corporate sponsorships may fall short. This transition highlights the need for filmmakers to adopt hybrid financing strategies in Nigeria’s dynamic film industry.

Leveraging Digital Platforms for Film Financing

Digital crowdfunding platforms like NaijaFund and Patreon have enabled Nigerian filmmakers to raise over ₦200 million collectively since 2021, offering an alternative to traditional film production budget constraints. These platforms allow creators to engage directly with audiences, turning fans into micro-investors while testing market demand before full-scale production.

Streaming giants like Netflix and Amazon Prime have injected $23 million into Nollywood acquisitions since 2022, with original content deals becoming viable funding solutions for projects rejected by conventional financiers. Such partnerships often include production advances, addressing investment opportunities in Nigerian cinema while expanding global reach beyond theatrical limitations.

Emerging blockchain-based platforms like FilmChain now facilitate transparent royalty distributions, solving persistent challenges of financing Nollywood movies through smart contracts. As these digital models mature, they complement—rather than replace—the hybrid financing strategies discussed earlier, setting the stage for real-world success stories in the next section.

Success Stories of Nigerian Filmmakers Who Secured Funding

Building on the digital funding models discussed earlier, director Kayode Kasum raised ₦12 million through NaijaFund for his 2022 project “Sugar Rush,” demonstrating how crowdfunding platforms can overcome film production budget constraints in Nigeria. The campaign attracted 1,400 backers, validating market demand before filming began—a strategy now replicated by emerging filmmakers across Lagos.

Netflix’s $3 million acquisition of “The Milkmaid” after its 2020 Oscar qualification showcases how international partnerships for film funding in Africa can elevate projects rejected by local financiers. Director Desmond Ovbiagele leveraged this deal to access global audiences while retaining creative control, proving alternative financing models for Nollywood can yield commercial and critical success.

Blockchain solutions also delivered results, with producer Chinaza Onuzo using FilmChain to distribute ₦8.2 million in transparent royalties to 17 investors for her 2023 drama “Underbelly.” These cases illustrate how hybrid strategies—combining digital platforms with traditional funding—are solving persistent challenges of financing Nollywood movies, paving way for the practical funding steps we’ll explore next.

Practical Steps to Secure Funding for Your Film Project

Start by validating market demand through pre-production crowdfunding campaigns like Kayode Kasum’s ₦12 million NaijaFund success, leveraging platforms such as NaijaFund or Kickstarter to gauge audience interest. Complement this with targeted pitches to private investors, highlighting ROI potential using data from similar Nollywood projects that recouped investments within six months of release.

Explore hybrid financing by combining blockchain-based royalty models (like FilmChain’s ₦8.2 million distribution for “Underbelly”) with grants from Nigeria’s Project ACT Nollywood, which disbursed ₦420 million to 100 filmmakers in 2023. Simultaneously, submit polished screenplays to international film funds like the Berlinale World Cinema Fund, which has funded 11 African projects since 2020.

Finally, structure deals with streaming platforms early, mirroring Desmond Ovbiagele’s Netflix negotiation for “The Milkmaid,” while retaining backend participation through transparent contracts. These actionable strategies bridge film funding gaps in Nigeria, setting the stage for systemic solutions we’ll explore in closing.

Conclusion: Bridging the Film Funding Gaps in Nigeria

Addressing Nigeria’s film funding crisis requires a multi-pronged approach, combining government intervention, private sector partnerships, and innovative financing models like crowdfunding. For instance, the success of platforms like Piggyvest in funding indie projects shows the potential of alternative financing models tailored to local realities.

Filmmakers must also leverage international partnerships, as seen with Netflix’s investments in Nollywood, while advocating for policy reforms to ease access to bank loans and grants. The recent ₦1 billion grant by the Bank of Industry for creative projects demonstrates progress, but sustainability demands broader industry collaboration.

By adopting these strategies, Nigerian filmmakers can transform funding challenges into opportunities for growth, ensuring the industry’s global competitiveness. The next section will explore case studies of successful funding models that can serve as blueprints for emerging filmmakers.

Frequently Asked Questions

What practical steps can Nigerian filmmakers take to secure funding for mid-budget films (₦20-₦50 million)?

Combine crowdfunding campaigns on NaijaFund with targeted pitches to private investors and apply for hybrid grants like Project ACT Nollywood which disbursed ₦420 million in 2023.

How can filmmakers leverage corporate sponsorships to bridge funding gaps without compromising creative control?

Pitch strategic product placement deals like Peak Milk’s 30% budget coverage for 'Brotherhood' while retaining editorial independence through clear contract terms.

Which international grants offer the most accessible funding opportunities for Nigerian filmmakers?

Focus on programs like the Ford Foundation and Berlinale World Cinema Fund which prioritize African stories and have funded projects like 'Mami Wata' with €50k.

Can blockchain solutions really help Nigerian filmmakers manage royalties and attract investors?

Yes platforms like FilmChain enabled transparent ₦8.2 million royalty distributions for 'Underbelly'—use smart contracts to build investor trust in recoupment models.

What’s the fastest way to validate market demand before seeking full film funding?

Launch pre-production crowdfunding campaigns like Kayode Kasum’s ₦12 million NaijaFund success to test audience interest and attract serious investors.