The Growing Demand for Borehole Drilling Services

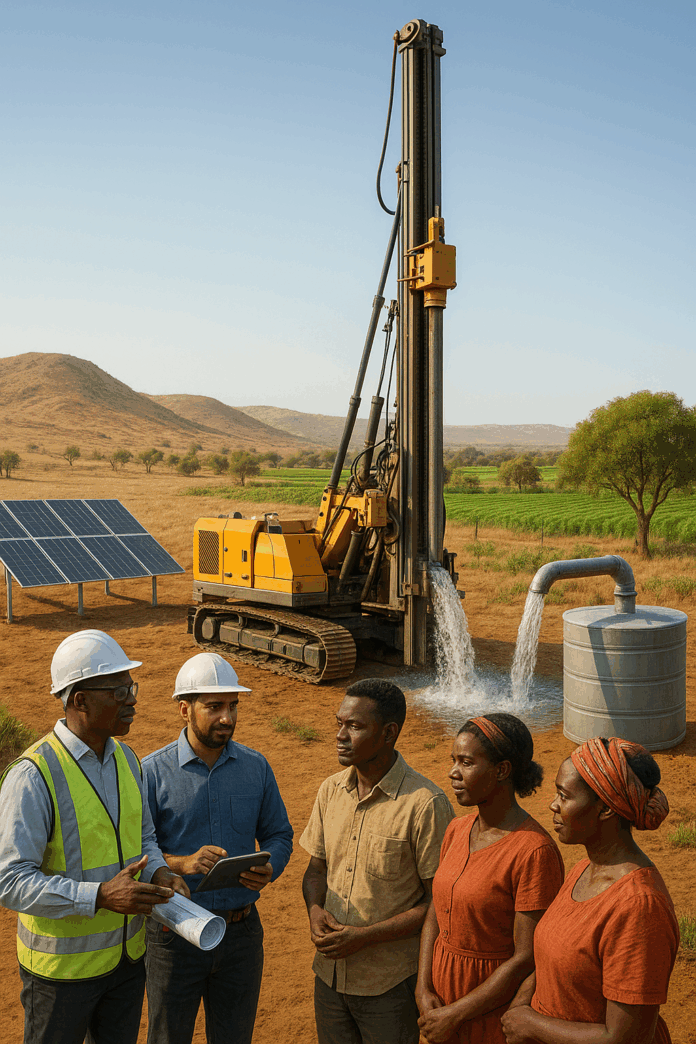

Imagine standing on a sunbaked plot of land, miles from the nearest municipal water line, and knowing that beneath your feet lies the key to survival: groundwater. For millions worldwide, borehole drilling isn’t just a technical process—it’s a lifeline. By 2025, the global borehole drilling equipment market is projected to surge past $6 billion, driven by escalating water scarcity, agricultural demands, and industrial growth. Investors and entrepreneurs eyeing this sector aren’t just chasing profits—they’re stepping into a role that blends innovation with humanitarian impact.

But let’s be real: this isn’t a gold rush without risks. Dry wells, equipment failures, and regulatory hurdles can sink even the most promising ventures. The key to thriving here? Balancing technical precision with community-centric strategies. Whether you’re a startup founder or an investor scouting scalable opportunities, understanding the trifecta of equipment maintenance, water needs assessment, and dry well management isn’t optional—it’s your roadmap to success.

Equipment Maintenance: Ensuring Long-Term Operational Efficiency

Picture a borehole drilling rig as the heart of your operation. When it’s healthy, it pumps life into projects. When it fails, everything grinds to a halt. Preventive maintenance isn’t just a checklist—it’s your armor against downtime.

1. Daily Rituals for Peak Performance

Every morning, before the rig roars to life, a seasoned operator checks the basics: lubricating moving parts, inspecting hydraulic lines for leaks, and testing pressure gauges. Weekly deep dives include examining drilling lines for fraying and ensuring mud circulation systems are free of clogs. Monthly overhauls? Think engine diagnostics and replacing worn seals. These routines aren’t just about compliance—they’re about squeezing every drop of productivity from your investment.

2. The Silent Killers: Corrosion and Wear

Drilling in saline-rich or acidic environments? Steel components can corrode faster than you’d expect. One operator in Texas learned this the hard way when a neglected swivel joint led to a $20,000 repair bill. Regular inspections of critical parts—like the drawworks’ winch drum or the mud pump’s valves—can spot early signs of wear. Pro tip: Partner with manufacturers offering API Q2-certified maintenance services. Their expertise ensures your rig meets emissions standards and avoids costly fines.

3. Tech to the Rescue

Imagine an AI system that predicts a pump failure three days before it happens. Predictive analytics tools are no longer sci-fi—they’re here, slashing downtime by up to 30% in pilot projects. Sensors monitor vibration patterns, temperature spikes, and fluid levels, sending alerts straight to your phone. For startups, leasing this tech (instead of buying outright) can cut upfront costs by 60%, freeing capital for other priorities.

Community Water Needs Assessment: Building Sustainable Solutions

Drilling a borehole isn’t just about hitting water—it’s about hitting the right water, in the right place, for the right people.

1. Listening to the Land (and the People)

In rural Kenya, a well-intentioned NGO drilled a borehole only to find it dry within a year. Why? They skipped the aquifer assessment. Modern hydrogeologists use tools like geochemical analysis and AI-driven modeling to map groundwater reserves. But data alone isn’t enough. Sit with villagers. Learn their water usage patterns. A farmer might need 500 gallons daily for irrigation, while a clinic prioritizes clean drinking water. Balancing these needs prevents over-extraction and community conflict.

2. The 15-50% Failure Trap

Globally, 15-50% of boreholes fail within two years due to poor design or maintenance. The fix? Co-create solutions with locals. Train community members to perform basic upkeep, like cleaning screens or testing water quality. In Zambia, a project that paired solar-powered pumps with village-led maintenance committees saw functionality rates soar to 90%. Investors take note: Projects with community buy-in attract ESG funding and reduce long-term risks.

3. Contracts That Care

Drafting a drilling contract? Bake in incentives for quality. One company in California ties 20% of payment to post-installation performance metrics, like consistent water yield over six months. Penalties for dry wells keep contractors accountable. And don’t forget permits—budget 5-20% of project costs for navigating water abstraction licenses and environmental impact assessments.

Managing Dry Wells: Mitigating Financial and Technical Risks

A dry well isn’t always a death sentence. Sometimes, it’s a detour.

1. Temporary vs. Permanent: Know the Difference

In Arizona, a rancher noticed his pump sputtering air. Instead of panicking, he halted usage for 48 hours. The well recovered—it was a seasonal dip, not a collapse. Tools like the Well Harvester® automate this balancing act, using sensors to adjust pumping rates in real time. For deeper issues, hydrofracturing (injecting high-pressure water to clear sediment) can revive yields by 1-10 gallons per minute. But if the aquifer’s gone? It’s time to drill anew.

2. When to Walk Away

A well in Nevada ran dry after decades of use. Instead of abandoning it, the owner repurposed it for geothermal heating, slashing energy costs by 40%. Creative pivots like this turn liabilities into assets. For investors, insuring against dry wells or negotiating revenue-sharing agreements with communities can hedge risks.

3. The $15,000 Lesson

Drilling a new well in 2025 averages $5,500-$15,000, but terrain and depth can push costs higher. In Florida’s limestone-rich regions, depths of 300+ feet are common, while softer soils in the Midwest cut costs. Partner with local drillers—they know the land’s quirks. And always test water quality post-drilling. Contamination from nearby farms or industries can render even the deepest well useless.

ROI and Scalability for Investors

Here’s the bottom line: Borehole drilling isn’t just about water—it’s about value.

1. High-Margin Niches

Industrial clients (mining, geothermal) pay premiums for specialized drilling, while rural projects offer volume. Government tenders, like USDA grants for decentralized water systems, add stability. In 2025, the Healthy H2O Act unlocked $20 million for private well treatments—a golden opportunity for contractors.

2. Franchising the Future

A startup in Nigeria scaled regionally by franchising drill rigs to local operators. Their secret? Standardized training and profit-sharing. Digital tools like SEO and social media attract clients without costly ad spends. One company in India doubled its leads by hosting YouTube tutorials on well maintenance.

3. Sustainability Pays

ESG funds love projects that align with UN Sustainable Development Goals. A borehole initiative in drought-prone Kenya secured carbon credits by reducing diesel-powered water hauling. For every dollar invested in eco-friendly rigs, returns jumped 35% from grants and tax breaks.

Key Takeaways for Entrepreneurs

- Maintenance First: A well-oiled rig saves $50k annually in repairs.

- Community = Currency: Co-designed projects have 70% higher success rates.

- Dry Wells Aren’t Dead: Repurpose, insure, or innovate.

Resources & Next Steps

- Tools: Predictive maintenance apps like TIBCO; community survey templates from WaterAid.

- Training: Certifications in hydrogeology or ESG compliance.

- Networking: Join forums like the National Groundwater Association for insider insights.

This isn’t just a business—it’s a legacy. Every borehole drilled responsibly today ensures water flows tomorrow. Ready to dig deeper?