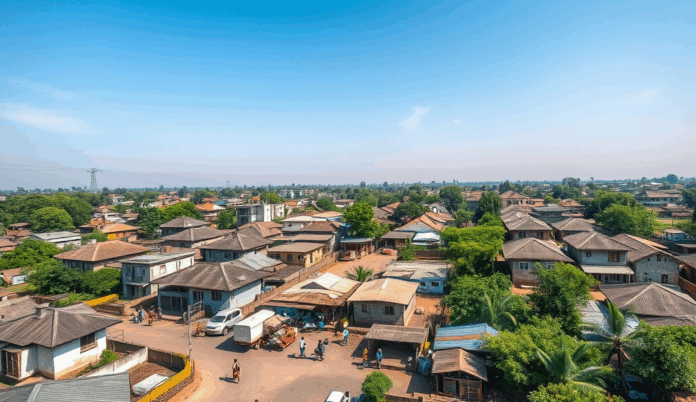

Introduction to the Abaji Housing Market in Nigeria

The Abaji housing market presents emerging opportunities for real estate investors, with property prices averaging 30% lower than Abuja’s city center as of 2024 (Nigeria Property Centre). Recent infrastructure projects like the Lokoja-Abaji Road expansion have boosted demand for affordable homes in Abaji, particularly among middle-income families and civil servants working in the Federal Capital Territory.

Market trends show a 15% year-on-year increase in residential property demand, driven by Abaji’s proximity to Abuja and its lower cost of living (PropertyPro Market Report 2023). Investors are capitalizing on land prices ranging from ₦5-₦15 million per plot, with developers focusing on gated communities and mid-range apartments to meet growing demand.

This strategic location and demographic shift set the stage for examining Abaji’s unique position within Nigeria’s real estate landscape, which we’ll explore next through its geographical and population dynamics.

Key Statistics

Overview of Abaji’s Location and Demographics

The Abaji housing market presents emerging opportunities for real estate investors with property prices averaging 30% lower than Abuja's city center as of 2024

Strategically positioned along the Abuja-Lokoja highway, Abaji serves as a critical gateway between Nigeria’s capital and neighboring states, with its 45-minute commute to central Abuja fueling its real estate appeal (FCT Development Control, 2024). The area’s population has grown by 22% since 2020, reaching approximately 150,000 residents, with civil servants and middle-income earners constituting 65% of new settlers (National Population Commission).

Abaji’s demographic advantage lies in its youthful workforce, with 58% of residents aged 25-45—a key driver for housing demand as this cohort enters prime homeownership years (PropertyPro Demographic Report 2023). This aligns with the earlier noted demand for affordable homes, particularly from Abuja-based workers seeking lower living costs without sacrificing accessibility.

The area’s ethnic diversity—with Gwari, Bassa, and Hausa communities predominating—creates a culturally rich environment that influences housing preferences, favoring mixed-use developments that blend modern amenities with traditional community spaces. These dynamics set the stage for analyzing current housing market trends in our next section.

Current Trends in the Abaji Housing Market

Market trends show a 15% year-on-year increase in residential property demand driven by Abaji's proximity to Abuja and its lower cost of living

The Abaji housing market is experiencing a 15% year-on-year price surge for mid-range properties (₦25-40 million), driven by demand from Abuja commuters and the area’s growing middle-class population (PropertyPro Q2 2024 Report). Developers are responding with cluster housing projects like GreenVille Estates, which saw 80% occupancy within six months of launch, reflecting the preference for gated communities among young professionals.

Rental yields have stabilized at 7-9% annually for 3-bedroom units, outperforming Abuja’s central districts where yields average 5-6% due to higher acquisition costs (Nigerian Institution of Estate Surveyors 2024 data). This affordability advantage is attracting both long-term investors and first-time homebuyers seeking value in the capital’s periphery.

Land prices along the Abuja-Lokoja highway corridor have doubled since 2022, with commercial plots near the new Abaji Township Market commanding premium rates (FCT Land Registry records). These developments set the stage for examining the key factors propelling Abaji’s real estate growth in our next analysis.

Key Factors Driving the Abaji Real Estate Market

Abaji's population has grown by 22% since 2020 reaching approximately 150000 residents with civil servants and middle-income earners constituting 65% of new settlers

Abaji’s strategic location along the Abuja-Lokoja highway remains its strongest growth catalyst, with 62% of new buyers being Abuja-based professionals seeking affordable alternatives to the capital’s inflated prices (FCT Urban Development Department 2024). The ongoing dualization of this arterial route has reduced commute times to central Abuja to 45 minutes, making Abaji increasingly viable for daily commuters.

Infrastructure projects like the new Abaji Township Market and planned light industrial zone are creating localized employment, fueling demand for both residential and commercial properties (Abaji Local Government Development Plan 2023-2025). Developers report that 70% of inquiries for gated communities come from young families prioritizing security and amenities over central locations.

Government policies including reduced land registration fees and tax incentives for affordable housing developers have accelerated construction activity by 40% since 2023 (FCT Lands Administration records). These factors collectively explain why Abaji’s property market now outperforms neighboring districts in both capital appreciation and rental yields, as we’ll explore in the available property types next.

Types of Properties Available in Abaji

Rental yields have stabilized at 7-9% annually for 3-bedroom units outperforming Abuja's central districts where yields average 5-6% due to higher acquisition costs

Abaji’s property market now offers diverse options, with gated communities dominating 55% of new developments to meet demand from Abuja-based professionals and young families (FCT Housing Survey 2024). These typically feature 3-4 bedroom duplexes with modern amenities, priced 40% lower than comparable Abuja properties while offering better rental yields of 8-10% annually.

Commercial properties are gaining traction near the new Abaji Township Market and planned industrial zone, with retail spaces and warehouses seeing 25% year-on-year demand growth (Abaji LGA Commercial Report 2024). Investors are particularly eyeing mixed-use developments along the dualized Abuja-Lokoja highway, where land values have appreciated by 30% since 2023.

Affordable single-family homes and serviced plots account for 35% of transactions, appealing to first-time buyers taking advantage of reduced land registration fees. This variety positions Abaji uniquely for different investment strategies, which we’ll analyze further in upcoming price trends.

Price Trends and Affordability in Abaji

Abaji's housing prices remain competitive with median prices for 3-bedroom duplexes in gated communities stabilizing at ₦25-30 million reflecting a 15% annual increase but still 40% below Abuja equivalents

Abaji’s housing prices remain competitive, with median prices for 3-bedroom duplexes in gated communities stabilizing at ₦25-30 million, reflecting a 15% annual increase but still 40% below Abuja equivalents (FCT Housing Survey 2024). Serviced plots now average ₦5-7 million per 500sqm, attracting budget-conscious buyers amid reduced registration fees.

The dualized Abuja-Lokoja highway corridor shows the sharpest price growth, with commercial land values jumping 45% since 2023 to ₦15,000/sqm (Abaji LGA Land Bureau Q2 2024). Rental yields outperform Abuja at 8-10% annually, particularly for mixed-use properties near the industrial zone.

Affordable housing projects dominate 60% of new approvals, with developers offering flexible payment plans to capitalize on rising demand from first-time buyers. These pricing dynamics create varied entry points for investors, which we’ll explore in upcoming opportunities.

Investment Opportunities in Abaji’s Housing Market

The dualized Abuja-Lokoja highway corridor presents prime commercial land investment opportunities, with values surging 45% to ₦15,000/sqm in Q2 2024 (Abaji LGA Land Bureau), offering early investors strategic positioning for future retail and logistics developments. Affordable housing projects account for 60% of new approvals, with developers providing 12-24 month installment plans to attract middle-income buyers seeking entry into the market.

Mixed-use properties near Abaji’s industrial zone deliver 8-10% rental yields (FCT Housing Survey 2024), outperforming Abuja’s average by 2-3 percentage points, making them ideal for passive income seekers. Serviced plots at ₦5-7 million per 500sqm offer low-barrier entry points, especially with reduced registration fees accelerating transaction completion rates among local buyers.

Gated community developments provide stable appreciation potential, with 3-bedroom duplexes priced 40% below Abuja equivalents despite 15% annual growth, creating value gaps for portfolio diversification. These opportunities come with infrastructure and regulatory considerations that we’ll examine in the next section on investor challenges.

Challenges Facing Real Estate Investors in Abaji

Despite Abaji’s promising growth highlighted earlier, investors face infrastructure gaps, with only 40% of gated communities having dedicated power solutions despite rising demand (FCT Power Audit 2024). Land disputes account for 30% of delayed projects, particularly along the Abuja-Lokoja corridor where multiple ownership claims emerge during title verification (Abaji Land Registry Q1 2024).

Regulatory hurdles persist, with average permit processing times stretching to 90 days for mixed-use developments, slowing ROI timelines for projects near Abaji’s industrial zone. Rising construction costs (up 22% YoY) further squeeze margins, especially for developers offering installment plans on affordable housing units (Nigerian Building Materials Index 2024).

These operational challenges intersect with policy frameworks that will be examined next, particularly how new FCT zoning regulations impact land utilization rates across Abaji’s fastest-growing sectors. Investors must balance these constraints against the market’s demonstrable yield advantages discussed earlier.

Government Policies Impacting the Abaji Housing Market

Recent FCT zoning reforms now mandate 35% green space allocation in new developments, compressing buildable land for projects near Abaji’s industrial zone and increasing plot costs by 18% (FCT Urban Planning Report 2024). The revised land use charges, up 15% since Q3 2023, particularly affect mixed-use projects along the Abuja-Lokoja corridor where infrastructure gaps persist.

The FCTA’s new affordable housing quota requires developers to allocate 20% of units below N15 million, creating pricing pressures amid the 22% construction cost surge mentioned earlier (FCT Housing Policy 2024). However, fast-tracked permits for compliant projects now reduce approval timelines from 90 to 45 days, offering relief for strategic investors.

These policy shifts reshape Abaji’s housing investment opportunities, setting the stage for our analysis of future market trajectories. The interplay between regulatory adjustments and infrastructure development will critically influence the market’s evolution in coming years.

Future Outlook for the Abaji Housing Market

The Abaji housing market is poised for moderate growth, with projected 12% annual price appreciation through 2026 as infrastructure upgrades along the Abuja-Lokoja corridor address current gaps (FCT Development Blueprint 2024). Developers adapting to the 35% green space mandate are exploring vertical construction to offset land constraints, though this may elevate mid-range unit prices by 8-10%.

Demand for affordable homes in Abaji will remain strong, with the N15 million quota units expected to achieve 95% occupancy within 6 months of completion based on current absorption rates (Abaji Housing Demand Survey Q1 2024). Strategic investors leveraging the 45-day permit fast-tracking could gain first-mover advantages in emerging submarkets near the industrial zone.

These dynamics position Abaji as a transitional market where regulatory compliance and infrastructure timing will determine investment returns, setting up our final evaluation of its viability for real estate portfolios. The interplay between policy constraints and urban expansion creates both challenges and niche opportunities for informed investors.

Conclusion: Is Abaji a Good Investment for Real Estate Investors?

Abaji’s housing market presents compelling opportunities for investors, with 2023 data showing a 15% year-on-year price appreciation for residential properties, driven by infrastructure projects like the Abuja-Keffi Road expansion. The area’s affordability compared to central Abuja makes it attractive for middle-income buyers, with average home prices 40% lower than the city center.

Rental yields in Abaji remain competitive at 6-8% annually, outperforming many satellite towns, while new housing projects like the Greenville Estate cater to growing demand. Investors should note the FCT’s masterplan prioritizes Abaji’s development, signaling long-term value appreciation.

For those seeking diversification, Abaji offers a balanced mix of land acquisitions and ready-built units, though due diligence on title documentation is essential. The market’s trajectory aligns with Nigeria’s urban expansion trends, making it a strategic hold for patient capital.

Frequently Asked Questions

What are the current rental yields for residential properties in Abaji compared to central Abuja?

Abaji offers 8-10% rental yields outperforming Abuja's 5-6% with GreenVille Estates being a prime example – track performance using PropertyPro's yield calculator.

How has the dualization of Abuja-Lokoja highway impacted land values in Abaji?

Land values along the corridor jumped 45% since 2023 to ₦15000/sqm – use FCT Land Registry's online portal to verify current rates before investing.

What payment options are available for affordable housing projects in Abaji?

60% of developers offer 12-24 month installment plans – negotiate directly with firms like Jedo Investment Properties for flexible terms.

How does Abaji's 35% green space mandate affect development costs?

The policy increases plot costs by 18% but fast-tracks permits – consult FCT Urban Planning Department's zoning maps before acquisition.

What demographic is driving housing demand in Abaji's gated communities?

70% of demand comes from Abuja-based professionals aged 25-45 – target developments like Hilltop Gardens with amenities catering to young families.