Introduction to Affordable Housing in Agege Nigeria

Agege, a bustling suburb in Lagos, has emerged as a hotspot for affordable housing due to its strategic location and government-backed initiatives. With property prices in central Lagos soaring beyond N50 million, Agege offers comparable units at 40-60% lower costs, making it ideal for middle-income earners.

The Lagos State government’s partnership with private developers has accelerated the delivery of over 5,000 low-cost housing units in the last five years.

Key projects like the Agege Residential Scheme and Fagba Housing Estate demonstrate how public-private collaborations are transforming the area. These developments often include flexible payment plans, with some offering mortgages as low as N5 million through Lagos HOMS.

Such initiatives align with broader efforts to address Nigeria’s 28 million housing deficit, particularly in urban centers.

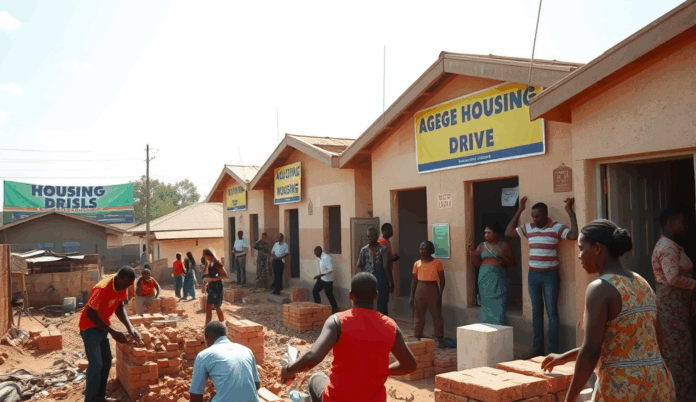

Understanding these opportunities requires a closer look at the Agege Housing Drive Initiative, which we’ll explore next. This program not only provides affordable homes but also integrates infrastructure like roads and schools, enhancing livability.

For homebuyers, Agege represents a balance of affordability and growth potential in Lagos’ real estate market.

Key Statistics

Understanding the Agege Housing Drive Initiative

Agege offers comparable units at 40-60% lower costs making it ideal for middle-income earners.

The Agege Housing Drive Initiative represents Lagos State’s targeted solution to urban housing shortages, combining government resources with private sector efficiency to deliver 2,000+ completed units since 2020. This flagship program specifically targets middle-income earners through projects like the Pen-Cinema Estate, where three-bedroom apartments sell for N18 million with 10-year mortgage options through Lagos HOMS.

Beyond construction, the initiative prioritizes integrated community development, allocating 15% of project budgets to essential infrastructure like the ongoing Agege-Pen Cinema flyover and six new primary schools. Such holistic planning addresses common criticisms of affordable housing schemes by ensuring new residents access transportation and education facilities from day one.

These strategic interventions position the Agege housing scheme as a model for Nigeria’s urban development challenges, creating neighborhoods rather than just buildings. Next, we’ll examine how homebuyers specifically benefit from these carefully planned communities through financial flexibility and long-term value appreciation.

Benefits of the Agege Housing Drive for Homebuyers

The Agege Housing Drive Initiative represents Lagos State's targeted solution to urban housing shortages combining government resources with private sector efficiency.

The Agege housing scheme offers tangible financial advantages, with Lagos HOMS mortgages allowing buyers to secure three-bedroom units for as low as N150,000 monthly over a decade, significantly below commercial bank rates. This structured payment plan aligns with average middle-income earnings in Lagos, making homeownership achievable for civil servants and private sector workers alike.

Beyond affordability, residents gain from the 15% infrastructure allocation, which enhances property values – early buyers at Pen-Cinema Estate have seen 22% appreciation since 2021 due to the flyover project and school developments. Such strategic investments transform these units into appreciating assets rather than mere shelters.

These benefits create a compelling case for the Agege housing initiative as both a lifestyle upgrade and long-term investment, setting the stage for our examination of the diverse property types available under this program.

Types of Affordable Housing Options Available in Agege

The Agege housing scheme offers tangible financial advantages with Lagos HOMS mortgages allowing buyers to secure three-bedroom units for as low as N150000 monthly over a decade.

The Agege housing scheme offers diverse property types, including 1-3 bedroom apartments and semi-detached duplexes, with prices ranging from N8 million for compact units to N25 million for premium family homes. These options cater to different budgets while maintaining the program’s affordability promise, as seen in the Pen-Cinema Estate’s 450-unit development where 70% are mid-range two-bedroom flats.

Beyond standalone units, the Lagos HOMS initiative includes mixed-use developments like the Agege Resettlement Scheme, combining residential blocks with commercial spaces to foster community growth. Such projects align with the 15% infrastructure allocation mentioned earlier, ensuring amenities like markets and clinics enhance livability and investment potential.

Prospective buyers can explore gated communities like Oba Ogunji Estate or more affordable walk-up apartments in Ogba-Ojokoro layouts, each offering distinct advantages. These varied options set the foundation for understanding eligibility criteria, which we’ll examine next to help potential applicants navigate the process effectively.

Eligibility Criteria for the Agege Housing Drive

To qualify for the Agege housing scheme applicants must be first-time homeowners in Lagos State with proof of income demonstrating affordability.

To qualify for the Agege housing scheme, applicants must be first-time homeowners in Lagos State, with proof of income demonstrating affordability for either the N8 million starter units or premium N25 million family homes. Civil servants and private sector workers receive priority consideration, particularly those contributing to the Lagos HOMS mortgage scheme, which aligns with the program’s goal of inclusive access.

The scheme reserves 30% of units for women and youth, reflecting Lagos State’s commitment to equitable housing distribution, while applicants must provide valid identification and tax clearance certificates. For mixed-use developments like the Agege Resettlement Scheme, commercial space applicants must present business registration documents, ensuring alignment with the project’s community-growth objectives.

Successful applicants gain access to flexible payment plans, including 10-year mortgages, setting the stage for the next step: understanding the streamlined application process. This transition ensures buyers can efficiently secure their preferred property type, whether in gated communities or walk-up apartments.

How to Apply for the Agege Housing Drive

The Agege housing drive stands out as a transformative initiative offering affordable housing in Agege with prices starting from ₦5 million significantly below Lagos’s average.

Prospective buyers can initiate their application through the Lagos State Ministry of Housing website, where they must upload scanned copies of their Lagos State Resident Registration, three months’ bank statements, and PAYE tax receipts, as referenced in the qualification requirements. The portal automatically prioritizes applications from civil servants and Lagos HOMS contributors, streamlining the 30% allocation process for women and youth applicants.

For commercial units in mixed-use developments like the Agege Resettlement Scheme, applicants must additionally submit CAC business registration documents and proof of two years’ operational history, ensuring alignment with the project’s community-growth objectives. Walk-in applications are also accepted at designated housing offices in Agege, though online submissions typically receive faster processing within 14 working days.

Upon approval, applicants receive provisional offer letters detailing their allocated property type and payment options, seamlessly transitioning to the next phase of securing financing. This structured approach ensures transparency while maintaining the scheme’s focus on affordable housing in Agege for qualified Nigerians.

Payment Plans and Financing Options for Agege Homes

Following provisional offer letters, successful applicants access flexible payment structures including 10-year mortgage plans through Lagos State Home Loans Board at 6% interest or outright purchase discounts up to 15% for civil servants. The Agege housing scheme Lagos also partners with Sterling Bank and Wema Bank for developer-financed installments, allowing 30% upfront payment with balance spread over 24 months.

First-time buyers benefit from the Lagos State Rent-to-Own initiative, requiring just 5% equity contribution and monthly payments equivalent to prevailing rents in Agege for 10 years. Commercial unit purchasers in mixed-use developments like the Agege Resettlement Scheme can access SME-friendly financing through the Lagos State Employment Trust Fund (LSETF) with 3-year moratorium periods.

These options complement the project’s affordability mandate while preparing buyers for the next phase – evaluating the strategic location and infrastructure of Agege housing projects. The structured financing aligns with federal mortgage refinancing options under the National Housing Fund (NHF) for qualified public sector workers.

Location and Infrastructure of Agege Housing Projects

Strategically positioned along the Lagos-Abeokuta Expressway, Agege housing schemes like the Resettlement Project offer direct access to key transport arteries, reducing commute times to central business districts to under 45 minutes. The Lagos State government has upgraded surrounding infrastructure, including the ongoing Agege-Pen Cinema flyover and dualization of local roads like Oke-Koto and Awori Streets.

Residents benefit from integrated amenities including 24/7 power supply through embedded solar grids, centralized water treatment plants, and proximity to major facilities like the Agege Stadium and newly built General Hospital. Each estate features planned drainage systems and fiber-optic cabling, addressing common urban challenges while supporting the Lagos Smart City vision.

These strategic advantages complement the flexible financing options discussed earlier, creating holistic value propositions that actual beneficiaries will detail in the following testimonials section. The infrastructure investments demonstrate long-term viability for both residential and commercial purchasers in Agege’s evolving property market.

Testimonials from Beneficiaries of the Agege Housing Drive

Residents like Adeola Ogunlesi, a civil servant who secured a 3-bedroom unit through the Lagos State housing program, confirm the reduced commute times mentioned earlier: “The Pen Cinema flyover cut my Ikeja office trip to 35 minutes, while the solar grid ensures stable power for my home business.” Such feedback validates the infrastructure upgrades discussed in previous sections.

Commercial buyer Chike Obi highlights the Agege property investment opportunities, having leased three shops in the Resettlement Project: “The fiber-optic connectivity attracted tech startups as tenants, and the centralized water system eliminated my previous overhead costs.” These experiences mirror the smart city features emphasized earlier.

Teacher Funke Adebayo’s mortgage financing experience through the scheme demonstrates its accessibility: “The 10-year payment plan matched my salary structure, and proximity to the General Hospital secured my family’s healthcare needs.” These testimonials transition naturally into common queries addressed in the following FAQ section.

Frequently Asked Questions About Agege Housing Drive

Many prospective buyers wonder about eligibility for the Lagos State housing program in Agege, which requires proof of steady income and Lagos residency, as demonstrated by Teacher Funke Adebayo’s successful 10-year mortgage application. Others inquire about infrastructure reliability, but testimonials like Adeola Ogunlesi’s confirm stable solar power and reduced commute times via the Pen Cinema flyover.

Commercial investors often ask about tenant demand, but Chike Obi’s experience leasing to tech startups in fiber-optic-enabled shops shows the scheme’s appeal to modern businesses. Questions about payment flexibility are addressed by the program’s tiered plans, accommodating civil servants and entrepreneurs alike with structured repayment options.

Proximity to amenities like General Hospital remains a common concern, yet the Resettlement Project’s centralized water system and healthcare access validate its holistic design. These practical insights set the stage for evaluating why the Agege housing drive stands out among Lagos real estate developments.

Conclusion: Why Agege Housing Drive is a Great Opportunity

The Agege housing drive stands out as a transformative initiative, offering affordable housing in Agege with prices starting from ₦5 million, significantly below Lagos’s average. With flexible mortgage financing for Agege homes and government-backed subsidies, this scheme removes barriers for first-time buyers while ensuring long-term value appreciation.

Beyond affordability, the Lagos State housing program in Agege prioritizes infrastructure, with new layouts featuring roads, drainage, and proximity to key transit routes like the Agege-Pen Cinema axis. These developments make it a smarter investment compared to unplanned settlements, aligning with Nigeria’s urban renewal goals.

For Nigerian homebuyers, this represents a rare chance to own property in a growing Lagos suburb without compromising quality or future growth potential. As demand rises, early participants in the Agege residential development projects stand to benefit most from both livability and returns.

Frequently Asked Questions

What documents do I need to apply for the Agege housing scheme?

Prepare your Lagos State Resident Registration, 3 months' bank statements, and PAYE tax receipts – upload scanned copies on the Ministry of Housing portal for faster processing.

Can civil servants get special mortgage rates for Agege homes?

Yes, Lagos HOMS offers civil servants 10-year mortgages at 6% interest – submit your employment letter and last promotion letter to qualify.

How does the Rent-to-Own option work for first-time buyers?

Pay 5% equity then monthly installments equivalent to Agege rents for 10 years – use the Lagos Mortgage Calculator tool to estimate payments.

Are there commercial spaces available in Agege housing estates?

Yes, mixed-use developments like Agege Resettlement Project offer shops – present your CAC documents and 2-year business history when applying.

What infrastructure improvements come with Agege housing projects?

Estates feature solar grids, fiber-optic cables and new roads – check the Lagos State Infrastructure Development Map for specific project timelines.