Introduction to the Gaming Industry Growth in Nigeria

Nigeria’s gaming industry is experiencing unprecedented growth, fueled by increasing smartphone penetration and a tech-savvy youth population. With over 60 million active gamers, the country now ranks among Africa’s top three gaming markets, according to a 2023 report by Newzoo.

Local game developers like Maliyo Games and Kuluya are driving innovation while international publishers are taking notice of Nigeria’s potential. The rise of esports in Nigeria has further accelerated this growth, with tournaments like the African Gaming League attracting thousands of participants annually.

This expansion creates exciting opportunities across mobile gaming trends in Nigeria and digital entertainment sectors, setting the stage for deeper exploration of the current market landscape. The next section will examine how these developments are shaping the present state of Nigeria’s gaming ecosystem.

Key Statistics

Current State of the Gaming Industry in Nigeria

Nigeria's gaming market now generates over $185 million annually with mobile gaming dominating 78% of revenue as smartphone adoption reaches 45% nationwide

Nigeria’s gaming market now generates over $185 million annually, with mobile gaming dominating 78% of revenue as smartphone adoption reaches 45% nationwide, per PwC’s 2024 report. Local studios like Gamsole and ChopUp continue expanding their catalogs with culturally relevant titles while attracting venture capital from firms like TLcom Capital.

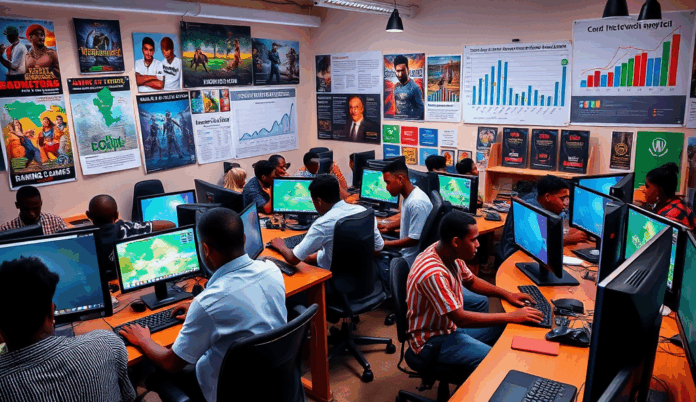

The esports ecosystem has matured significantly, with Lagos hosting Africa’s first franchised league (The Nigerian Esports League) featuring 16 professional teams across FIFA and PUBG Mobile. This professionalization mirrors global trends while creating new career paths for young Nigerians in shoutcasting, event management, and game development.

Infrastructure improvements are evident through partnerships like MTN’s 5G rollout for cloud gaming and Lagos State’s gaming innovation fund targeting early-stage startups. These developments set the foundation for examining the key factors driving youth engagement, which we’ll explore next.

Factors Driving the Growth of Gaming Among Young Adults

Esports’ professionalization has transformed gaming from a hobby into a viable career attracting sponsors like MTN and Pepsi with over 2000 Nigerians now employed in gaming-related roles nationwide

The rise of affordable smartphones and cheaper data plans has democratized gaming access, with 63% of Nigerian gamers aged 18-35 citing mobile convenience as their primary entry point, according to a 2023 GSMA report. Culturally resonant games like ChopUp’s *Arena of Glory* further fuel engagement by blending local folklore with competitive gameplay mechanics.

Esports’ professionalization, highlighted by The Nigerian Esports League’s success, has transformed gaming from a hobby into a viable career, attracting sponsors like MTN and Pepsi. This shift mirrors global trends while addressing youth unemployment, with over 2,000 Nigerians now employed in gaming-related roles nationwide.

Infrastructure investments, including MTN’s 5G rollout and Lagos State’s innovation fund, have lowered barriers for aspiring developers and gamers alike. These advancements set the stage for exploring the platforms and trends shaping Nigeria’s gaming landscape next.

Popular Gaming Platforms and Trends in Nigeria

Mobile gaming’s dominance has reshaped Nigeria’s gaming economy with local developers like Maliyo Games capitalizing on the demand for hyper-casual titles tailored to African audiences

Mobile gaming dominates Nigeria’s gaming landscape, with platforms like Google Play Store and App Store seeing 78% of local downloads in 2023, per Statista. Homegrown alternatives like Gamr and Ludare also gain traction by offering localized payment options and tournaments for games like *Arena of Glory*.

PC and console gaming are growing steadily, driven by Lagos-based gaming hubs like The Nest and VGG Arena, which host weekly FIFA and Call of Duty tournaments. These spaces leverage MTN’s 5G rollout to reduce latency, attracting both casual players and esports aspirants.

Live-streaming on Twitch and YouTube Gaming has surged, with Nigerian creators like *Papa Oyin* amassing over 100,000 followers by broadcasting local tournaments. This trend aligns with the professionalization of esports, setting the stage for deeper exploration of mobile gaming’s industry impact.

Impact of Mobile Gaming on the Industry

The rise of esports has created new revenue streams with sponsorships from brands like MTN and Pepsi injecting over $2 million into the ecosystem in 2023 alone

Mobile gaming’s dominance has reshaped Nigeria’s gaming economy, with local developers like Maliyo Games capitalizing on the demand for hyper-casual titles tailored to African audiences. The sector’s growth is further fueled by affordable smartphones and MTN’s expanding 5G network, enabling seamless gameplay even in rural areas.

Platforms like Gamr and Ludare have unlocked monetization opportunities through localized in-app purchases and ad-supported models, attracting investors eyeing Nigeria’s $250 million gaming market. This shift has also spurred job creation, with Lagos-based studios hiring young talent for game design and community management roles.

As mobile gaming bridges accessibility gaps, it lays the foundation for esports’ mainstream adoption, with tournaments like *Arena of Glory* showcasing Nigeria’s competitive potential. This synergy between mobile adoption and competitive gaming sets the stage for deeper exploration of esports’ role in the ecosystem.

Role of Esports in the Nigerian Gaming Scene

Nigeria’s gaming market is projected to surpass $126 million by 2025 driven by rising mobile gaming trends and youth engagement with local developers leading the charge

Building on mobile gaming’s explosive growth, esports has emerged as a key driver of Nigeria’s gaming industry, with tournaments like *Arena of Glory* attracting over 50,000 participants annually. Platforms such as Gamr and Ludare now host regional qualifiers, offering cash prizes that incentivize competitive play while fostering local talent development.

The rise of esports has also created new revenue streams, with sponsorships from brands like MTN and Pepsi injecting over $2 million into the ecosystem in 2023 alone. This financial boost supports professional teams like *Dey Play* and *Naija Esports*, further legitimizing gaming as a viable career path for Nigerian youth.

However, infrastructure gaps and inconsistent internet connectivity remain hurdles, setting the stage for the next discussion on challenges facing the industry. Despite these obstacles, esports continues to solidify Nigeria’s position as a competitive gaming hub in Africa.

Challenges Facing the Gaming Industry in Nigeria

Despite the rise of esports and mobile gaming, Nigeria’s gaming industry faces persistent infrastructure challenges, with only 48% of the population having reliable internet access, hindering competitive play and game development. High data costs, averaging ₦1,000 per GB, further limit accessibility for aspiring gamers and developers in low-income communities.

Power instability remains a critical barrier, with frequent outages disrupting tournaments and development cycles, as seen during the 2023 *Arena of Glory* qualifiers where matches were postponed due to blackouts. Limited access to affordable gaming hardware also sidelines talent, with entry-level PCs costing over ₦300,000—nearly six months’ minimum wage.

While sponsorships and investments grow, inconsistent policies and lack of government support slow sector maturation, contrasting with South Africa’s structured gaming ecosystem. These hurdles highlight the need for localized solutions as the industry pivots toward untapped opportunities for young adults.

Opportunities for Young Adults in the Gaming Sector

Despite infrastructure hurdles, Nigeria’s gaming industry offers young adults lucrative pathways, from esports careers to game development, with local studios like Maliyo Games creating culturally relevant mobile titles. The rise of esports in Nigeria has birthed professional gamers earning up to ₦500,000 monthly through tournaments like *GamrX*, while content creators monetize gameplay streams on platforms like YouTube and Twitch.

Affordable mobile gaming is bridging gaps, with 72% of Nigerian gamers using smartphones, fueling demand for localized content and indie developers leveraging tools like Unity. Initiatives like *Naija Game Dev* foster skills through workshops, empowering youth to create games addressing local narratives, such as *Lagos GT*—a racing game featuring Nigerian landmarks.

As sponsorships grow, young adults can tap into roles in game testing, community management, or digital marketing, with startups like Kuluya hiring locally. These opportunities set the stage for discussing how government and private sector support could further accelerate growth.

Government and Private Sector Support for Gaming

The Nigerian government has begun recognizing gaming’s economic potential, with initiatives like the National Information Technology Development Agency (NITDA) offering grants to startups such as Maliyo Games. Private investors are also stepping in, with platforms like Carry1st securing $20 million in funding to expand Africa’s gaming ecosystem, signaling confidence in Nigeria’s market.

Corporate sponsorships from brands like MTN and Pepsi have boosted esports tournaments, including GamrX, creating revenue streams for players and organizers. Meanwhile, tech hubs like CcHub host game development bootcamps, bridging the gap between talent and industry opportunities while fostering localized content creation.

With these collaborative efforts, Nigeria’s gaming industry is poised for accelerated growth, setting the stage for exploring future prospects in the next section.

Future Prospects of the Gaming Industry in Nigeria

Nigeria’s gaming market is projected to surpass $126 million by 2025, driven by rising mobile gaming trends and youth engagement, with local developers like Maliyo Games leading the charge in creating culturally relevant content. Increased internet penetration and affordable smartphones will further accelerate this growth, positioning Nigeria as a key player in Africa’s digital entertainment expansion.

The rise of esports in Nigeria, fueled by tournaments like GamrX and corporate sponsorships, hints at a thriving competitive scene, potentially attracting global investors and partnerships. Tech innovations, such as blockchain gaming and VR integration, could redefine the industry, offering new opportunities for startups and established players alike.

With continued government support through NITDA grants and private sector investments like Carry1st’s $20 million funding, Nigeria’s gaming ecosystem is set to unlock untapped potential, bridging the gap between talent and global markets. This momentum sets the stage for a transformative era, as explored in the concluding section.

Conclusion on the Growth of Gaming in Nigeria

The gaming industry in Nigeria has evolved from a niche hobby to a thriving sector, driven by mobile gaming trends and the rise of esports among young adults. With over 60% of gamers accessing titles via smartphones, local developers like Maliyo Games are creating culturally relevant content that resonates with Nigerian audiences.

Investment opportunities in Nigerian gaming are expanding as startups like Gamr and Ludo host tournaments attracting thousands of participants. Tech innovations such as blockchain gaming and VR arcades in Lagos showcase the sector’s potential to rival global markets while fostering youth engagement.

As digital entertainment growth continues, collaborations between telcos and developers hint at an even brighter future for Nigeria’s gaming ecosystem. The next phase will likely focus on scaling infrastructure to support this momentum while nurturing homegrown talent.

Frequently Asked Questions

How can I start a career in esports in Nigeria?

Join local tournaments like GamrX and build your skills while networking on platforms like Ludare to connect with teams and sponsors.

What affordable tools can help me develop mobile games in Nigeria?

Use free game engines like Unity or Godot and participate in workshops by Naija Game Dev to learn coding and design basics.

Where can I find gaming communities to join in Nigeria?

Check out Lagos-based hubs like The Nest or online groups on Gamr’s platform to connect with fellow gamers and developers.

How do I monetize my gaming content as a Nigerian streamer?

Stream on Twitch or YouTube Gaming and leverage local sponsorships by showcasing tournaments like Arena of Glory to grow your audience.

What are the best mobile games developed by Nigerian studios?

Try Maliyo Games’ *Arena of Glory* or ChopUp’s *Lagos GT* for culturally relevant gameplay that supports local developers.