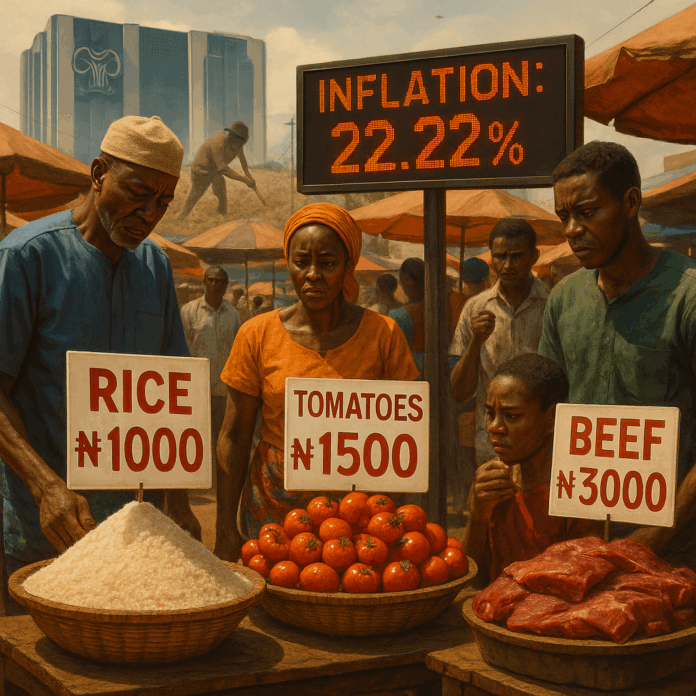

Nigeria’s inflation rate has declined for the third consecutive month, reaching 22.22% in June 2025, down from 22.97% in May, according to the latest data from the National Bureau of Statistics (NBS). This marks the lowest inflation rate since April 2023, signaling tentative progress in stabilizing prices amid ongoing economic reforms. The drop is attributed to base effects, a relatively stable exchange rate, and monetary policy tightening. Despite the overall decline, food inflation remains stubbornly high at 21.97%, driven by seasonal demand during the Sallah festival, which pushed livestock and commodity prices up by 35%. Meanwhile, core inflation (excluding food and energy) rose to 22.76%, reflecting persistent underlying price pressures.

This article unpacks the latest Nigeria inflation 22.22% report, analyzing trends, sectoral impacts, policy implications, and future projections. Whether you’re an economist tracking macroeconomic shifts or a concerned citizen navigating rising costs, this breakdown offers actionable insights.

Key Inflation Figures and Trends

Headline vs. Monthly Inflation

Nigeria’s latest inflation data reveals a mixed economic landscape. While the headline rate declined to 22.22%, underlying pressures persist. Year-on-Year (YoY) inflation dropped to 22.22% in June, down from 22.97% in May. Month-on-Month (MoM) inflation rose slightly to 1.68%, up from 1.53%—indicating prices are still climbing, just at a slower annual pace.

Food Inflation Remains Sticky

Despite the overall dip, food inflation accelerated to 21.97%, up from 21.14% in May. Key drivers include Sallah festival demand, which spiked livestock prices by 35% MoM, and grain shortages due to delayed farming seasons and insecurity in the North.

Core Inflation (Excluding Food & Energy) Climbs

Core inflation rose to 22.76%, up from 22.28%—a red flag for policymakers. Major contributors were transport (2.45% MoM), housing (130.9 CPI points), and healthcare (1.92% MoM).

Historical Context

Nigeria’s inflation has averaged 14.12% since 1996, peaking at 47.56% in 1996. The current 22.22% rate remains far above the CBN’s target band of 6-9%, but the downward trend suggests policy measures are gaining traction.

Drivers of the Inflation Decline

Exchange Rate Stabilization

The naira’s relative stability since Q1 2025 has been crucial. Parallel market rates held between ₦1,450-₦1,500/$ for three consecutive months, while official window rates narrowed to ₦1,380/$ (from ₦1,700+ in January). Forex liquidity improved through CBN’s clearance of a $7 billion backlog, helping curb import costs.

Monetary Policy Tightening

The CBN’s aggressive stance since mid-2024 shows signs of working. The benchmark interest rate stands at 26.25% (up from 18.75% in 2023), the Cash Reserve Ratio was increased to 45% for commercial banks, and Open Market Operations (OMO) mopped up ₦12 trillion in excess liquidity. Economists note these measures are finally slowing money supply growth (down to 18% YoY from 30% in 2024).

Base Effects & Seasonal Factors

The June slowdown partly reflects a high base from 2024 when fuel subsidy removal spiked prices, post-harvest season effects for some staple crops, and reduced festive spending after Eid-el-Kabir. However, these are temporary reliefs—structural issues remain unresolved.

Sectoral Breakdown of Inflation: Winners and Losers

The Pressure Cookers (Still Overheating)

Food & Beverages (52% of CPI weight) posted a 21.97% YoY increase, with rice (+38% YoY), beef (+42% YoY), and tomatoes (+65% YoY) as the biggest movers. Housing & utilities (17% weight) saw rent inflation hit 28.3% YoY in Lagos, while transport (7% weight) recorded a 25% YoY rise in intra-city fares.

The Cooling Zones (Price Relief)

Clothing & footwear posted only a 12.1% YoY increase, boosted by cheap Chinese imports. Communication inflation was flat at 0.07% MoM, and education inflation eased to 15.8% YoY as private schools froze fees to retain students.

Regional Disparities: Nigeria’s Inflation Hotspots

The national 22.22% inflation rate tells only part of the story—the pain varies dramatically across states. Borno (38.93%), Kogi (34.15%), and Plateau (32.35%) are the hardest-hit due to conflict, floods, and farmer-herder clashes. In contrast, Katsina (16.25%) and Delta (18.41%) recorded the lowest rates, benefiting from local grain reserves and increased oil production.

Urban areas average 23.14% inflation (driven by services), while rural areas sit at 22.70% (food production offsets some costs). This geographic breakdown reveals Nigeria’s twin inflation crisis—conflict-driven shortages in the North and service-sector inflation in Southern cities.

Policy Responses: Assessing Nigeria’s Anti-Inflation Measures

What’s Working

The interest rate hammer (26.25% MPR) cooled speculative forex demand, strategic food releases (40,000MT grain distribution in Q2) temporarily capped rice and maize prices, and BDC reforms narrowed the parallel-premium to 12% (from 45% in 2024).

What’s Failing

Fuel subsidy aftermath lingers as Dangote refinery operates at 60% capacity (PMS averages ₦850/liter). Security blindspots in farm corridors destroyed 40% of grain output in three Northern states, and the N62,000 minimum wage proposal is now worth 23% less due to inflation.

Future Projections: When Will Nigeria’s Inflation Break?

Trading Economics models forecast a 20% inflation rate by September 2025, assuming continued monetary tightening and stable FX rates. The baseline scenario projects inflation tapering to 17% in 2026 and 15% in 2027 if reforms hold. Wildcards include global oil prices (a $10/barrel drop could slash FX reserves by $3 billion), policy reversals, and climate shocks.

Navigating Nigeria’s Inflation Maze

The 22.22% rate represents fragile progress. Food inflation (21.97%) remains the Achilles’ heel, while geographic disparities demand localized solutions. Policymakers must sustain tight monetary policy, accelerate refinery operations, and implement targeted security ops in agricultural zones. Businesses should hedge against currency risks, and households can prioritize nutrient-dense local alternatives.

The coming months will test whether this decline marks a true turning point or a temporary respite. Vigilance is key as Nigeria’s inflation battle continues.