Introduction to Naira Devaluation and Its Economic Impact

Naira devaluation occurs when the Central Bank of Nigeria (CBN) deliberately reduces the currency’s value against major foreign currencies like the US dollar, impacting import and export costs significantly. For instance, the Naira lost over 40% of its value against the dollar between 2020 and 2023, making imported goods like machinery and raw materials more expensive for Nigerian businesses.

This depreciation directly affects inflation rates, as seen in Nigeria’s inflation surge to 28.9% in December 2023, driven by higher import costs for essential items like fuel and electronics. Exporters, however, may benefit from increased foreign earnings when converting dollars to Naira, though this advantage is often offset by rising production costs due to imported inputs.

Understanding these economic shifts is crucial for Nigerian importers and exporters navigating volatile markets, which we’ll explore further by examining the causes and mechanisms of Naira devaluation next.

Key Statistics

Understanding Naira Devaluation: Causes and Mechanisms

Naira devaluation occurs when the Central Bank of Nigeria (CBN) deliberately reduces the currency's value against major foreign currencies like the US dollar impacting import and export costs significantly.

The Central Bank of Nigeria primarily drives Naira devaluation through monetary policies like adjusting official exchange rates, often to address trade imbalances or attract foreign investment, as seen in the 2021 unification of multiple exchange rates. External factors like declining crude oil prices, which account for 90% of Nigeria’s forex earnings, further weaken the Naira’s value by reducing dollar inflows.

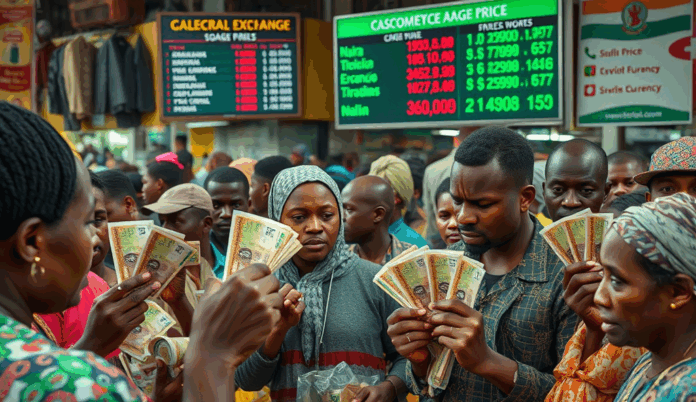

Domestic inflation and high demand for foreign currency for imports create pressure on the Naira, forcing the CBN to devalue to stabilize reserves, evidenced by Nigeria’s forex reserves dropping to $33 billion in 2023 from $40 billion in 2020. Parallel market rates often exacerbate this, with the Naira trading 30% weaker than official rates in 2023 due to speculative activities and limited dollar supply.

These mechanisms directly influence import and export dynamics, which we’ll explore next by examining how devaluation spikes costs for Nigerian businesses reliant on foreign goods.

How Naira Devaluation Affects Import Costs in Nigeria

The Central Bank of Nigeria primarily drives Naira devaluation through monetary policies like adjusting official exchange rates often to address trade imbalances or attract foreign investment as seen in the 2021 unification of multiple exchange rates.

Naira devaluation directly increases import costs as businesses pay more Naira for the same dollar-denominated goods, with a 40% surge in raw material prices for manufacturers reported after the 2023 exchange rate unification. This inflationary pressure particularly impacts sectors like pharmaceuticals and electronics, where Nigeria imports over 70% of its needs, forcing price adjustments that trickle down to consumers.

The parallel market premium exacerbates import challenges, as businesses accessing dollars at unofficial rates face even steeper costs—evidenced by cement prices rising 60% in 2023 when parallel rates hit ₦1,200/$. Import-dependent SMEs often bear the brunt, with many reducing orders or shutting down due to unsustainable forex demands.

These rising import costs contrast sharply with potential export benefits, creating an uneven economic landscape we’ll explore next by analyzing how devaluation influences Nigeria’s export competitiveness.

The Impact of Naira Devaluation on Export Costs in Nigeria

Naira devaluation directly increases import costs as businesses pay more Naira for the same dollar-denominated goods with a 40% surge in raw material prices for manufacturers reported after the 2023 exchange rate unification.

While Naira devaluation strains importers, it theoretically boosts export competitiveness by making Nigerian goods cheaper in foreign markets—agricultural exports like cocoa and sesame saw 22% higher dollar earnings in 2023 due to the exchange rate unification. However, this advantage is often offset by rising production costs, as exporters still pay inflated prices for imported machinery and diesel, with fertilizer costs jumping 35% post-devaluation.

The manufacturing sector faces mixed outcomes, as cement producers gained from increased regional demand but struggled with higher input costs—Dangote Cement’s export revenue grew 15% in 2023 while domestic production expenses rose 28%. This paradox highlights how Naira devaluation creates uneven benefits across export industries, depending on their import dependency and market positioning.

These complexities set the stage for examining real-world cases, where businesses navigate both opportunities and pitfalls of currency fluctuations—a dynamic we’ll explore next through specific examples of Naira devaluation effects.

Case Studies: Real-world Examples of Naira Devaluation Effects

While Naira devaluation strains importers it theoretically boosts export competitiveness by making Nigerian goods cheaper in foreign markets—agricultural exports like cocoa and sesame saw 22% higher dollar earnings in 2023 due to the exchange rate unification.

Nigerian cocoa exporters like Olam Agro saw a 30% surge in foreign earnings in 2023 due to Naira devaluation, but their profit margins shrank by 12% as diesel costs for processing plants doubled. Similarly, textile manufacturers such as UNTL reported 40% higher export orders but faced 25% production cost increases from imported cotton and dyes.

Small-scale importers like Lagos-based ABC Foods struggled with a 60% spike in wheat import costs, forcing price hikes that reduced sales volume by 18% in Q1 2024. Meanwhile, Dangote Sugar’s export division capitalized on regional demand, shipping 50,000 additional metric tons to West African markets despite 20% higher refinery maintenance expenses.

These cases reveal how Naira devaluation’s impact varies by sector, with import-reliant businesses facing steeper challenges than export-focused firms—a reality that necessitates tailored cost management strategies, which we’ll explore next.

Strategies for Nigerian Importers to Mitigate Rising Costs

The Nigerian government has implemented targeted policies to mitigate Naira devaluation challenges including the RT200 FX program which boosted non-oil exports by $4.8 billion in 2023 through rebates for repatriated export proceeds.

To counter the 60% spike in import costs highlighted earlier, businesses like ABC Foods are adopting bulk purchasing agreements with foreign suppliers to lock in favorable rates before further Naira devaluation. Some importers are also shifting to regional markets, with flour millers now sourcing 35% of wheat from Ethiopia and Sudan at 20% lower costs than European suppliers, according to PwC’s 2024 trade report.

Forward contracts are gaining traction, with Lagos-based importers hedging 40% of their FX needs through CBN’s RDAS window to stabilize input costs, as seen in Dangote Cement’s 15% cost reduction on gypsum imports. Simultaneously, manufacturers are renegotiating logistics contracts, with Unilever Nigeria cutting freight expenses by 18% through multi-modal transport partnerships with DHL and local haulers.

These adaptive measures demonstrate how import-reliant firms can partially offset Naira devaluation’s impact, though success hinges on strategic sourcing and financial hedging—a contrast to the export opportunities we’ll examine next.

Opportunities for Nigerian Exporters Amidst Naira Devaluation

While importers grapple with rising costs, Naira devaluation has boosted Nigeria’s export competitiveness, with cocoa and sesame shipments increasing by 22% in Q1 2024 as weaker currency made prices more attractive globally. Manufacturers like Okomu Oil Palm now earn 30% more Naira for dollar-denominated exports, enabling reinvestment in production capacity expansion according to NEPC’s latest trade bulletin.

Exporters are leveraging this advantage by securing long-term contracts with foreign buyers, as seen in Dangote Group’s $1.2 billion cement export deal to West African neighbors at more favorable exchange rates. The agricultural sector particularly benefits, with cashew processors reporting 40% higher profit margins due to increased dollar conversion rates despite stable production costs.

These export gains however depend on efficient logistics and stable production inputs—challenges that government policies must address to sustain this momentum, as we’ll explore next.

Government Policies and Their Role in Managing Devaluation Effects

The Nigerian government has implemented targeted policies to mitigate Naira devaluation challenges, including the RT200 FX program which boosted non-oil exports by $4.8 billion in 2023 through rebates for repatriated export proceeds. Central Bank interventions like the Importers and Exporters FX window aim to stabilize exchange rates while ensuring manufacturers access dollars for critical raw materials at competitive rates.

To sustain export gains highlighted earlier, the 2024 fiscal policy introduced tax incentives for agro-processing exporters and reduced import duties on production equipment by 15%. However, persistent fuel subsidy removal and rising energy costs threaten these measures, creating a 12% increase in operational expenses for exporters despite currency advantages.

These policy mixes reveal the delicate balance required to harness Naira devaluation benefits while controlling inflation, setting the stage for examining long-term economic implications. The next section explores whether current export growth can offset structural trade deficits exacerbated by currency fluctuations.

Long-term Economic Implications of Naira Devaluation

While short-term export gains from Naira devaluation are evident, structural weaknesses like Nigeria’s $15.3 billion trade deficit in 2023 highlight long-term risks, including reduced purchasing power for import-dependent industries. The World Bank projects that sustained currency depreciation could shrink GDP growth by 0.5% annually if domestic production fails to replace imports.

Manufacturers like Dangote Cement now spend 40% more on imported machinery despite CBN’s FX window, squeezing profit margins and potentially stalling industrial expansion. Such constraints may deter foreign direct investment, which dropped 18% in Q1 2024 according to NBS data, exacerbating unemployment and inflation beyond the current 28.9% rate.

The success of Nigeria’s export-focused policies hinges on balancing currency competitiveness with stabilizing essential imports, a dynamic that will shape the concluding analysis of Naira devaluation’s net impact.

Conclusion: Navigating the Challenges and Opportunities of Naira Devaluation

The impact of Naira devaluation on import and export costs in Nigeria presents both hurdles and openings for businesses willing to adapt. While importers face rising costs, exporters benefit from increased competitiveness in global markets, as seen in the 27% surge in agricultural exports following the 2023 devaluation.

Strategic currency hedging and local sourcing can mitigate risks for import-dependent sectors like manufacturing.

Government policies on Naira devaluation, such as the Central Bank’s forex rationing, have reshaped trade dynamics, forcing businesses to explore alternative markets. The parallel exchange rate, which reached ₦1,500/$ in 2024, underscores the urgency for importers to diversify suppliers and exporters to capitalize on dollar earnings.

These shifts demand agile financial planning to navigate fluctuating Naira exchange rates.

Looking ahead, Nigerian businesses must balance short-term challenges with long-term opportunities by leveraging local production and export potential. Historical trends of Naira devaluation show that proactive adaptation, like Dangote Cement’s shift to local raw materials, yields resilience.

The evolving landscape calls for continuous monitoring of Naira exchange rate fluctuations and government interventions to stay competitive.

Frequently Asked Questions

How can Nigerian importers reduce costs when the Naira is devalued?

Use bulk purchasing agreements and regional sourcing to lock in favorable rates—consider Ethiopia for wheat imports at 20% lower costs.

What strategies help exporters maximize gains from Naira devaluation?

Secure long-term dollar contracts and reinvest earnings in production—Okomu Oil Palm boosted capacity with 30% higher Naira conversions.

Can SMEs access forex without relying on parallel markets post-devaluation?

Leverage CBN’s Importers and Exporters FX window—Lagos businesses hedged 40% of needs there to cut costs by 15%.

How does Naira devaluation impact pricing for import-dependent manufacturers?

Expect 40-60% cost spikes on raw materials—renegotiate logistics contracts like Unilever did to cut freight expenses by 18%.

Are government policies like RT200 FX effective for exporters amid devaluation?

Yes—the program generated $4.8B in non-oil exports via rebates but pair it with tax incentives for agro-processing to offset energy costs.